Trade for Free

Easy to set up.

Ready to grow.

Start investing for your future right away.

Easy to set up.

Ready to grow.

Open an account and start trading in minutes.

It’s easy to choose the accounts that are right for you.

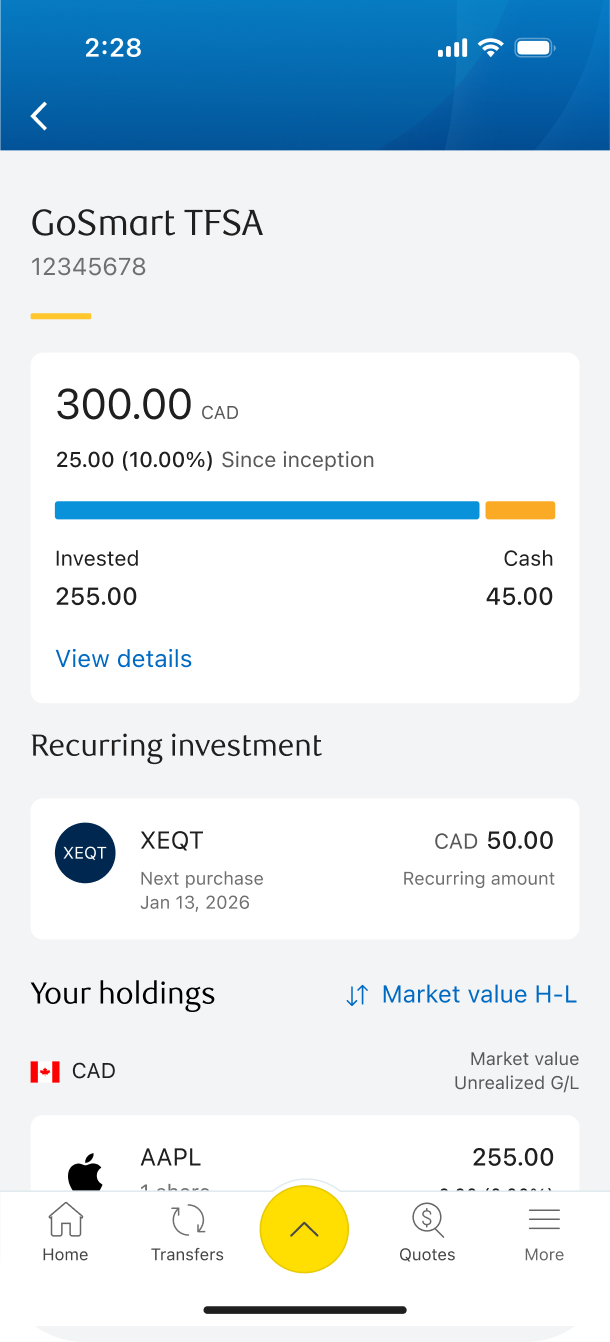

Automatic investments? Yes.

Create a recurring investment and watch it grow.

Access everything you need.

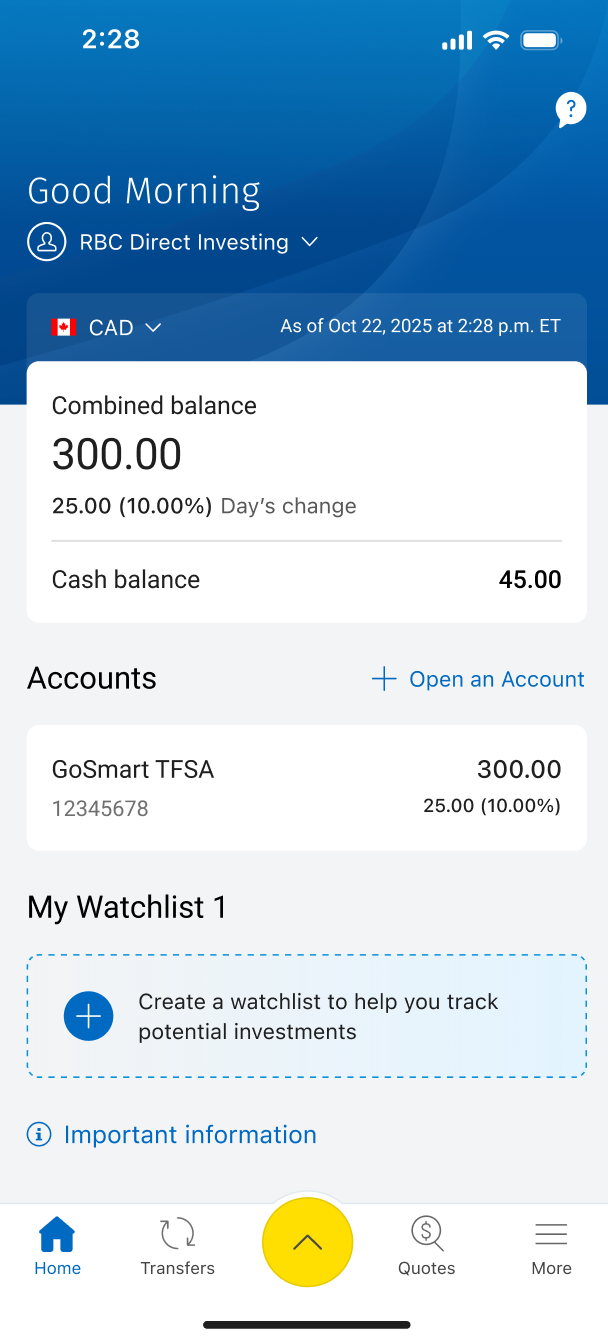

Invest where you bank and do it all in the RBC Mobile app.

Move your money instantly.

Move money in and out with no limits. Make quick, easy transfers between your RBC banking and GoSmart accounts.

Automate

your investing.

Save tax now

and in the future.

Make the most of built-in tax benefits. Open as many accounts as you need and never pay account fees.

Keep the growth, skip the tax with a TFSA.

With a Tax-free Savings Account (TFSA), everything you earn on your investment stays in your pocket, tax-free. Ideal for saving for a large purchase or a rainy day.

Own your first home sooner with an FHSA.

With tax deductions on what you contribute, and tax-free growth on what you earn, a First Home Savings Account (FHSA) can get you closer to your dream home.

Pay less tax today and save for your future with an RRSP.

Every dollar you put into a Registered Retirement Savings Plan (RRSP) lowers your taxes today and grows tax-free until retirement.

Invest on

your terms.

Everything you need to invest confidently at your fingertips.

Invest on your terms.

3 easy steps to

get started.

Sign up fast.

GoSmart is currently just for RBC clients using the RBC Mobile app. Sign in to get started. Not a client yet? Explore moreExplore more.

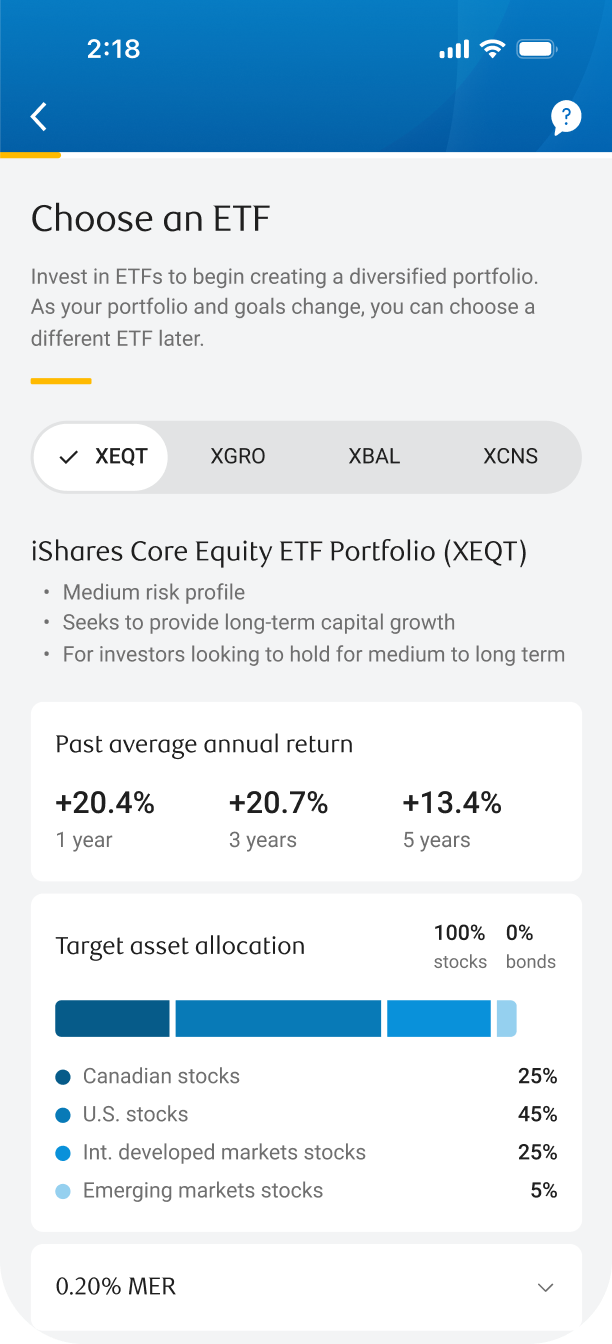

Invest your way.

Choose one of four all-in-one ETFs, or buy the stocks and ETFs you love commission-free. You can automate your investing with recurring contributions.

Track, adjust and trade.

Follow your investments, check in on the market and adjust – all from your GoSmart dashboard in the RBC Mobile app.

Start investing Start investingRBC Direct Investing

Helping Canadians grow their money.

RBC Direct Investing clients

Assets under administration

Our clients have grown their assets an average of 6x in the last 25 yearslegal disclaimer *

Ready to GoSmart?

Ready to GoSmart?

Start InvestingNew to investing?

Learn the basics with Investing Academy.

See how GoSmart compares to a full-suite RBC Direct Investing account.

FAQs

A GoSmart account is designed for beginning investors who are comfortable making their own investment decisions using the RBC Mobile App. Our aim is to simplify the process of 'how to invest' and provide commission-free trading in registered accounts.

GoSmart is a streamlined investing platform that only offers registered accounts in Canadian currency. A full-suite RBC Direct Investing account offers a wider range of investment products, both registered and non-registered accounts, multiple currencies, expanded tools and research geared towards established investors. Learn more How is a GoSmart account different from a full-suite RBC Direct Investing account? (opens new window).

- Streamlined experience with investing exclusively in registered accounts:

- Buy, hold, and sell Canadian and U.S. listed equities and ETFs

-

Commission-free trading:

- 50 free trades per year on Canadian or U.S. equities and ETFslegal disclaimer 1

- Uncapped commission-free trading on select ETFslegal disclaimer 2

- You can choose to set up a recurring investment on one of four all-in-one ETFs. Change your recurring investment at any time. This will not count towards your 50 free trades.

- Canadian dollar only. You can trade and hold U.S. listed equities and ETFs but you cannot hold U.S. dollars. If you place a trade for a U.S. denominated security the current foreign exchange conversion rate will be applied.legal disclaimer 3

-

These investment products and features are not available in a GoSmart account:

- Mutual Funds

- Fixed Income

- Foreign Securities (securities listed outside of Canada and the United States)

- Options

- Margin

Access to the above is available through a full-suite RBC Direct Investing account.

- No transfers-in-kind: you cannot transfer securities to this account; you can transfer cash and securities out.

There is no minimum. Opening a GoSmart account, or a full-suite RBC Direct Investing account is free.

You can trade for $0. You get unlimited trades on more than 50 select ETFs, plus 50 commission-free trades per year on Canadian and U.S. stocks and ETFs. After that, you pay $9.95 per trade. The RBC Direct Investing Commission and Fees schedule applies to a GoSmart account. Please visit www.rbcdirectinvesting.com/pricing for more information.

GoSmart is currently just for RBC clients using the RBC Mobile app. Not a client of RBC yet? Explore moreExplore more.

You can have multiple accounts. Invest for your retirement in a Registered Retirement Savings Plan (RRSP), your first home in a First Home Savings Account (FHSA), and anything you want in a Tax-Free Savings Account (TFSA).

You can call, email, visit a branch or one of our Investor Centres. Learn more about how Can I talk to anyone about opening a GoSmart account.

While you can trade and hold U.S. listed stocks and ETFs in your GoSmart account, orders placed in GoSmart accounts are settled only in CAD. When you place a trade for a U.S. denominated security, a conversion of your CAD funds will be applied automatically. The rate will be displayed before you place the trade.

You can trade in USD (and other currencies like GBP, HKD and EUR) through a full-suite RBC Direct Investing account.

GoSmart is not able to accept transfers in from other investment accounts, including in-kind transfers from RBC and other institutions.

Yes. If your investment needs change you can move from a GoSmart account to a full-suite RBC Direct Investing account at no charge. Your investments can be transferred in kind, so you don’t have to sell them, or as cash if you prefer.

Clients will need to contact us through Async Chat on the RBC Direct Investing App or call an Investment Services Representative at 1-800-769-2560 for help with this transfer.