What is a First Home Savings Account (FHSA)?

An FHSA is a type of Canadian registered plan (launched in 2023) designed to help first-time home buyers save for a down payment. Contributions are tax-deductible, growth is generally tax-free and qualifying withdrawals towards a first home are also tax-free. There are some rules to follow, such as the annual contribution limit of $8,000 and a lifetime limit of $40,000, but it can make a big difference for those trying to buy their first home.

Benefits of an FHSA

This new registered plan lets you contribute up to $8,000 per year to save towards a qualifyingLegal Disclaimer footnote 1 home, with built-in features to help you get there faster. The best part? Your investment earnings—including interest, and — grow tax-free.

Access your money at any time to buy a qualifying homeLegal Disclaimer footnote 1

Reduce your tax bill—contributions are tax-deductible

Participate in both the Home Buyer’s Plan (HBP) and FHSA

Numbers to Know

$0

Taxes you’ll pay on FHSA earnings and qualifying withdrawalsLegal Disclaimer footnote 1

$8,000

Annual FHSA contribution limit, plus unused contribution room (lifetime limit of $40,000)

15

Number of years you can contribute to your FHSA once you open it

A new, smart

way to invest.

Introducing GoSmart by RBC Direct Investing, designed for new investors and built to make investing easy.

Investments You Can Hold in Your FHSA

Enjoy total freedom to research and pick the investments that meet your needs.

Why Choose a Self-Directed FHSA at RBC Direct Investing?

Expand your investing knowledge with resources designed to help you take control:

- Find articles on the FHSA and other topics like stocks, options and more in the Investing Academy

- Learn the basics you need to build your strategy with the Investor’s Toolkit

- Watch educational videos and demos to see how to use our powerful trading platforms

Filter and choose investments using:

- Powerful screeners, market research and analysis, and more (Trading Tools and Investment Research)

- Economic insights on current events that could impact your investments

- Automatically reinvest dividendsLegal Disclaimer footnote 3 you earn from your equity investments

- Set up pre-authorized contributions to add money to your FHSA automatically and then invest it how you want

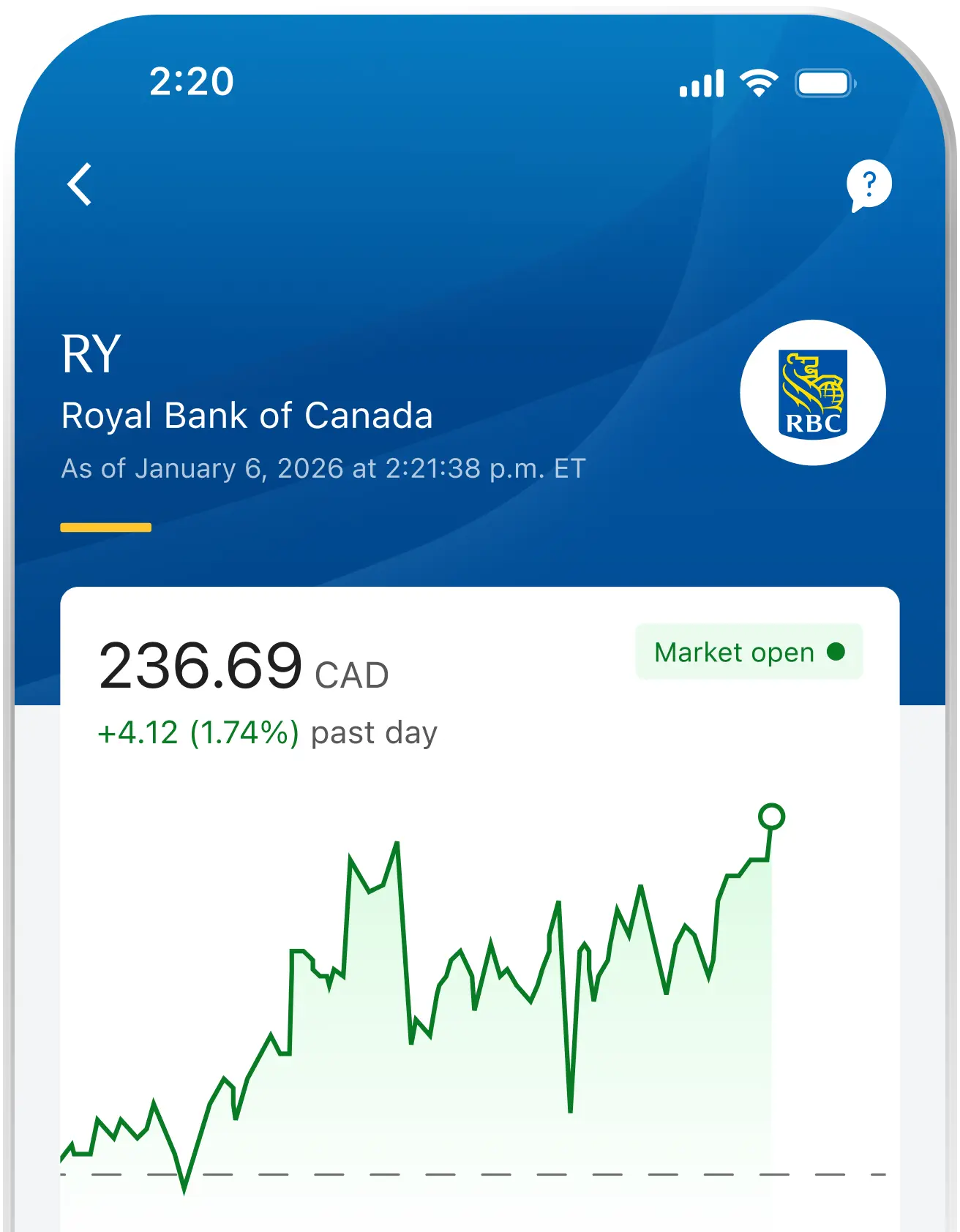

- Use the RBC MobileLegal Disclaimer footnote 4 app to act fast on opportunities

Receive guest access to our Online Investing platform with a risk-free Practice AccountLegal Disclaimer footnote 5. It’s a great way to practice buying and selling different investments before investing your own money. Free for RBC Online Banking and RBC Direct Investing clients.

Note: Practice FHSAs are not available. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online.

Enjoy benefits like real-time streaming quotesLegal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:

- Pay just $9.95 commission per online trade with no minimum balance or activityLegal Disclaimer footnote 7

- Use your Avion points for trade commissions or turn them into cash contributions

FHSA FAQs

A First Home Savings Account (FHSA) is a new type of registered plan that is designed to help Canadians contribute up to $40,000 on a tax-free basis to use towards the purchase of their first home.

You can open a self-directed First Home Savings Account (FHSA) at RBC Direct Investing and make tax-deductible contributions of up to $8,000 annually, to a lifetime maximum of $40,000. If you don’t contribute the full $8,000 in a single year, the balance can be carried forward and added to next year’s contribution amount. You can use up to $8,000 of your contribution room from last year, in addition to the $8,000 annual contribution limit. That means you could contribute a maximum of $16,000 in a given year.

At RBC Direct Investing, you have the freedom to pick, buy and manage the investments you want to hold in your FHSA. Your funds and any investment earnings can stay in the FHSA and grow tax-free with every contribution you make until you’re ready to buy your first home. As long as you use the funds for your qualifying first home, you won’t have to pay any taxes on your FHSA withdrawal(s).

The funds in your FHSA have to be used by December 31 of the 15th year after opening the account, or by December 31 of the year you turn 71, whichever comes earlier. If you have not used the funds in your FHSA by that time, you can transfer the funds from your FHSA on a tax-free basis to your Registered Retirement Savings Plan (RRSP) without impacting your RRSP contribution room, or to your Registered Retirement Income Fund (RRIF). Otherwise, you can withdraw funds from your FHSA, but your withdrawal will be taxed.

No, you can use both your First Home Savings Account (FHSA) as well as make a withdrawal from your Registered Retirement Savings Plan (RRSP) under the Home Buyers’ Plan (HBP) to purchase a qualifying home. Keep in mind that with an HBP withdrawal, you’ll have to repay any funds you withdraw from your RRSP. There is no repayment requirement for withdrawals from an FHSA.

You can also transfer funds tax-free from your RRSP to your FHSA, up to your contribution limit. However, transfers from an RRSP to an FHSA will not be tax deductible and won’t reinstate your RRSP contribution room.

It depends on your savings goals. A Registered Retirement Savings Plan (RRSP) is the go-to choice for most Canadians saving for retirement, and you can save on a tax-deferred basis until retirement. A Tax-Free Savings Account (TFSA) can be used to save for any purpose—including retirement or short-term goals. A TFSA also lets you invest in qualified investments, tax-free, and you can contribute and withdraw funds at any time. A First Home Savings Account (FHSA) can help you save for your first home, tax-free. You’ll pay no taxes on contributions or withdrawals, as long as you the funds to buy a qualifying home.

Keep in mind, you don’t have to pick just one—you can save for each of your goals in different accounts. Best of all, at RBC Direct Investing, you have the freedom to research and pick the investments that you want to hold in each of these accounts!

Not at all. A First Home Savings Account (FHSA) can help you save for your first home, even if you plan to buy in the next few years. You can contribute up to $8,000 each year, tax-free, towards your down payment. When you open an FHSA at RBC Direct Investing, you have the freedom to buy investments that make the most sense for your timeline.

To open a First Home Savings Account (FHSA), you must be:

- At least the age of majority in the province where you live

- A Canadian resident

- A first-time homebuyer (meaning, you and/or your spouse or common-law partner have not owned a home where you lived in the calendar year in which you open the account or at any time in the preceding four calendar years)

At RBC Direct Investing, you can hold the following investments in an FHSA:

- Stocks, options and bonds

- Exchange-traded funds (ETFs)

- Mutual funds

- Certain GICs

More products will become available over time.

You can complete your account application online in minutes and you’ll be able to start investing in your account within 24 hours.

Open your account now.No, the First Home Savings Account (FHSA) is an individual account and cannot be held jointly. However, you and your spouse could each have an FHSA and can combine your savings to buy a qualifying home.

Plus, attribution rules will not apply to amounts that you receive from your spouse or common-law partner that you contribute to your FHSA—and vice versa. This means that any investment earnings in your FHSA will not be added to your or your spouse’s taxable income regardless of whether you or your spouse fund the contribution, as long as they are used to purchase a qualifying home.

You can hold multiple First Home Savings Accounts (FHSAs), but your total contribution room will remain the same as if you had only one FHSA. Plus, your maximum participation period of 15 years will be based on the date you open your first account.

The lifetime contribution limit for the First Home Savings Account (FHSA) is $40,000.

The annual contribution limit for the First Home Savings Account (FHSA) is $8,000. You may also be able to contribute up to $8,000 of unused contribution room from the previous year. That means you could contribute up to $16,000 in a given year, if you have contribution room left from the year prior.

Note: You do not start accumulating contribution room until you open an FHSA account.

Yes, you can carry forward any unused FHSA contribution room from the prior year up to a maximum of $8,000 (subject to your lifetime contribution limit of $40,000). This means that if you contribute less than $8,000 in a given year, you can contribute the unused amount next year in addition to the $8,000 annual contribution limit.

For example, if you contribute $5,000 to your FHSA in 2023, you would be allowed to contribute $11,000 in 2024 (i.e., $8,000 plus the remaining $3,000 from 2023).

You can only make contributions to your own First Home Savings Account (FHSA). Your spouse or partner can also have their own FHSA and make contributions to their account.

Attribution rules will not apply to amounts that you receive from your spouse or common-law partner that you contribute to your FHSA—and vice versa. This means that any investment earnings in your FHSA will not be added to your or your spouse’s taxable income regardless of whether you or your spouse fund the contribution, as long as they are used to purchase a qualifying home.

If you over contribute to your First Home Savings Account (FHSA), you’ll pay a 1% tax on the overcontributed amount each month until the excess amount is withdrawn, or until more contribution room becomes available.

For example, if you contribute $12,000 to your FHSA in December (and you had no unused FHSA contribution room carried forward), you’ll pay $40 (1% x $4,000 x 1 month). More contribution room would become available January 1, so at that time, the additional $4,000 would no longer be considered an overcontribution.

At this time, we do not offer RRSP-to-FHSA transfers. We’re working to make them available this summer. Thank you for your patience.

It depends. If you make a qualifying tax-free withdrawal, no taxes will be deducted from the amount, and you will not have to include the amount in your taxable income that year.

To make a qualifying withdrawal from your First Home Savings Account (FHSA) you must meet the following conditions:

- Be a first-time homebuyer (meaning, you and/or your spouse or common-law partner have not owned a home where you lived in the calendar year in which you open the account or at any time in the preceding four calendar years)

- Have a written agreement to buy or build a qualifying home in Canada by October 1 of the year after you make the withdrawal from your FHSA

- Intend to live in the home within a year of buying or building it

- Be a resident of Canada throughout the period from the withdrawal to the acquisition of the house

You can also transfer funds from your FHSA to another FHSA, Registered Retirement Savings Plan (RRSP), or Registered Retirement Income Fund (RRIF) on a tax-free basis.

If you make a withdrawal from your FHSA for any other purpose, your withdrawal will be subject to withholding tax and the amount you withdraw will be added to your taxable income. Plus, your FHSA contribution room will not be re-instated.

Once you make a qualifying withdrawal, you will need to close your account and transfer or withdraw all funds left in your FHSA by December 31 of the following year. If you make a non-qualifying withdrawal, you will not have to close your account (unless you have had it for 15 years or are turning 71)—but your contribution room will not be reinstated.

You can make a withdrawal from your First Home Savings Account (FHSA) at any time.

Once you make a qualifying withdrawal, you can no longer make contributions. Plus, you will need to close your FHSA and transfer or withdraw all remaining funds in your FHSA by December 31 of the following year.

If you make a non-qualifying withdrawal, you will not be required to close your account, but your contribution room will not be reinstated.

The funds in your First Home Savings Account (FHSA) have to be used by December 31 of the 15th year after opening your first FHSA account or the year you turn 71, whichever comes first. If you have not used the funds in your FHSA by that time, they can be transferred tax-free to your Registered Retirement Savings Plan (RRSP) without impacting your RRSP contribution room, or to your Registered Retirement Income Fund (RRIF); otherwise, your withdrawal will be taxed.

If you withdraw only a portion of the funds from your First Home Savings Account (FHSA) to purchase your first home, you can transfer any remaining funds to your Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) on a tax-free basis on or before December 31 of the year following the initial withdrawal. Otherwise, you can withdraw the remaining balance, but it will be taxed.

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage.Legal Disclaimer footnote 8 (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.Legal Disclaimer footnote 9)

.

You may only use your Avion points through RBC DI to: (1) pay for Canadian or

U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or

(2) transfer points for cash contributions in CAD to your eligible RBC Direct

Investing accounts. It is your responsibility to make sure you have sufficient

contribution room within your registered plan when redeeming points for cash

contributions in CAD to your registered accounts and/or when you use your Avion

points to pay for Canadian or U.S. equity trade commissions on a registered

account. The Canada Revenue Agency may apply tax penalties for

over-contributions. RBC Direct Investing is not responsible for any such

penalties.

.

You may only use your Avion points through RBC DI to: (1) pay for Canadian or

U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or

(2) transfer points for cash contributions in CAD to your eligible RBC Direct

Investing accounts. It is your responsibility to make sure you have sufficient

contribution room within your registered plan when redeeming points for cash

contributions in CAD to your registered accounts and/or when you use your Avion

points to pay for Canadian or U.S. equity trade commissions on a registered

account. The Canada Revenue Agency may apply tax penalties for

over-contributions. RBC Direct Investing is not responsible for any such

penalties.

Get up to $10,000 in travel valuelegal disclaimer †!

Earn 1 point for every $2 dollars invested plus 12,500 bonus points —up to 500,000 Avion points.

As an Avion Rewards member, you can redeem Avion points for:

- Flights, hotels and car rentals

- Cash contributions to your RBC Direct Investing account(s)—or to pay for trade commissionslegal disclaimer 9

- Gift cards and merchandise from thousands of brands

- And more…

Offer ends March 31, 2026. Conditions apply.

How to Get this Offer

-

Open one or more by March 31, 2026.

-

Contribute or transfer-in funds within one or more eligible accounts by May 29, 2026.

Ways to contribute:

- Make lump sum contributions equaling at least $5,000, or

- Set up and process pre-authorized contributions (PACs) of $500+ per month

- Or do a combination of both

-

Be an Avion Rewards member by May 29, 2026 (if you're not already a member). It’s free and easy to join.

Maintain your minimum contribution balance and/or pre-authorized contributions until February 28, 2027.

We’ll deposit your Avion points into your Avion Rewards account in four payments. Each payment will be made within eight weeks after: May 31, 2026; August 31, 2026; November 30, 2026; and February 28, 2027.

Earn 1 Avion point for every $2 dollars invested, plus 12,500 bonus points —up to 500,000 Avion points!

| Qualifying Net Contributions (CAD): | Avion points you will receive: | Value (CAD): |

|---|---|---|

| $5,000 (minimum) | 15,000 | $350 (round-trip flight for a quick getaway) |

| $45,000 | 35,000 | $750 (round-trip flight to explore North America) |

| $105,000 | 65,000 | $1,300 (round-trip flight to visit Europe) |

| $975,000 | 500,000 | $10,000 (5 round-trip flights to see the world) |

You can also redeem points for hotels, car rentals, gift cards, merchandise, cash contributions to an RBC Direct Investing account, to pay for trade commissionslegal disclaimer 9 and more!

Terms and Conditions apply. See full offer terms and conditions.