Benefits of a RRIF

A RRIF is like an extension of your Registered Retirement Savings Plan (RRSP), but instead of putting money in, you withdraw from it for retirement income. The best part? Your investments can continue to grow tax-deferred.

Keep deferring taxes on investment earnings

Withdraw as much or as little retirement income as you wantLegal Disclaimer footnote 1

Choose when to receive your income—from monthly to annually

Numbers to Know

71

Age at which you must convert your RRSP to a RRIF or other income sourceLegal Disclaimer footnote 1

5.28%

Minimum percentage RRIF payout you must take at age 71—it increases every year

$0

Taxes you’ll pay on investment earnings while that money remains in a RRIF (withdrawals are taxed)

Why Choose a Self-Directed RRIF at RBC Direct Investing?

While you can’t contribute money to a RRIF, you can switch the types of investments you hold or purchase additional investments with funds that are already in the account.

- Pick from an extensive selection of GICs with competitive rates and a range of terms.

- Access one of Canada’s largest bond inventories, including government bonds, high yield bonds, strip bondsLegal Disclaimer footnote 2 and much more.

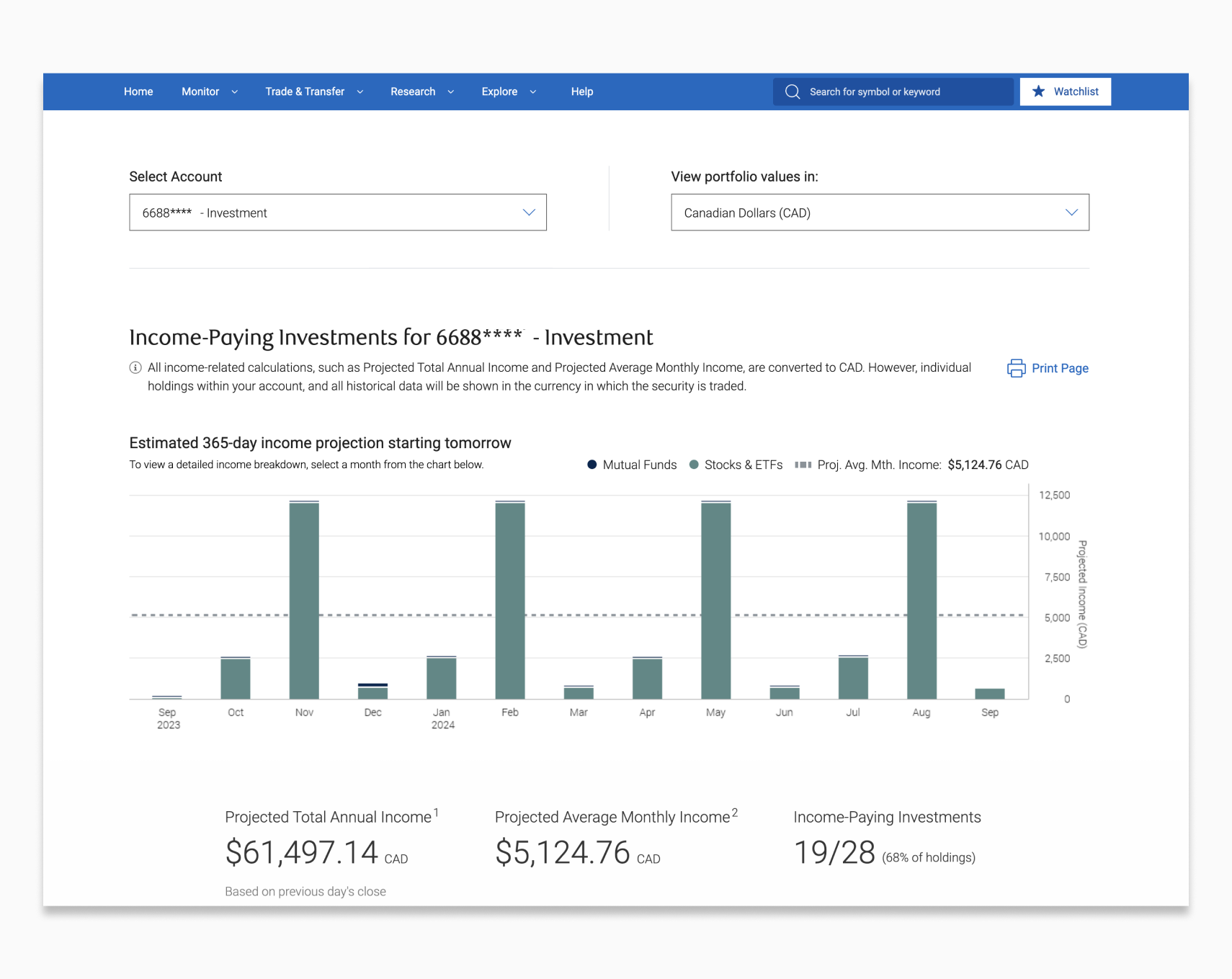

Use the interactive Income Projection tool to get a simulated estimate of what your dividend and interest income could look like in the future. Select specific accounts to review and get a month-by-month graph of potential returns over the next year.

Enjoy benefits like real-time streaming quotesLegal Disclaimer footnote 3 at no additional cost:

- Pay just $9.95 commission per online trade with no minimum balance or activity.Legal Disclaimer footnote 4

- Use your Avion points for trade commissions or turn them into cash contributions.

Hold a Range of Investments in Several Types of RRIFs

Depending on your needs, you can convert your RRSP to an individual RRIF, spousal RRIF or one of many . Plus, enjoy total freedom to research and pick investments that meet your needs.

Stocks

ETFs

Mutual Funds

GICs

Bonds

Options

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open a Self-Directed RRIF

Take control of your investments and your retirement income.

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeRRIF FAQs

A Registered Retirement Income Fund (RRIF) is a registered plan that provides you with income drawn from the investments and savings in your Registered Retirement Savings Plan (RRSP). RRIFs are similar to RRSPs in that they offer multiple investment options, allow for tax-deferred growth of qualified investments and funds are taxable as income when withdrawn. Unlike RRSPs, however, you can't make new contributions to a RRIF—you can only transfer funds from an RRSP or another RRIF.

You can convert your RRSP (or a portion of it) into a RRIF at any age you wish, but you must transfer all your RRSP funds into a retirement income option by December 31 of the year in which you turn 71.

To learn more, check out Understanding RRIFS: What You Need to Know.

The minimum amount you need to withdraw changes every year; it is based on your age and the market value of your RRIF at year end of the previous year. All withdrawals are taxable. If you have more than one RRIF, each plan will have its own minimum withdrawal.

You can always take more than the minimum; just keep in mind that it is taxable. Talk to your tax advisor about what’s best for you.

If you have a spouse or common-law partner, you can name them as a beneficiary or successor annuitant (not available in Quebec) of your RRIF when you die. Either way, the RRIF will go to your spouse without having to go through probate. Successor annuitant is usually the simpler option — your spouse basically becomes the annuitant of your RRIF and subsequent withdrawals will be taxed to them. If your spouse is named as a beneficiary, your executor will have some flexibility in allocating income tax between your spouse and your estate.

If you do not have a spouse or if you want to name someone other than your spouse, you can specify the beneficiary (or beneficiaries). In this case, the proceeds of your RRIF are withdrawn and paid to the beneficiaries. In provinces with probate fees, naming a beneficiary can reduce those fees.

Estate planning can be complex. If you have financial dependents such as minor children or a disabled adult child/grandchild, speak to an estate planning specialist for more information on naming a successor annuitant or beneficiary on your RRIF.

- You can convert your RRSP to a RRIF at any time, but must do so by the end of the year you turn 71. Most investments can transfer directly and do not have to be sold.

- Once opened, you must take a minimum withdrawal every year, starting in the year after you open your RRIF; the amount will change from year to year based on your age and the market value of the RRIF at year-end.

- You can also use your spouse or common-law partner’s age to calculate your minimum withdrawal amount. You must set this up before the first RRIF payment.

- RRIF payments are taxable in the year you withdraw them, and you will get a tax slip from the trustee of your RRIF.

A life income fund (LIF) is a special RRIF that contains terms prescribed by pension standards legislation. The funds in a LIF are “locked-in.” A LIF can be funded with money transferred from a registered pension plan (RPP). It can also be funded from money that was transferred from an RPP to a locked-in retirement account (LIRA). (A LIRA is a special RRSP that contains terms prescribed by pension standards legislation. The funds in a LIRA are also locked-in. For members of RPPs whose employment rights are governed federally instead of provincially, a LIRA is called a locked-in registered retirement savings plan.)

Like an RRSP, a LIRA terminates at the end of the year you turn 71. Before then, a LIRA must be converted to a LIF or used to buy an annuity. Like a RRIF, a LIF has a minimum amount that must be withdrawn each year. However, unlike a RRIF, a LIF has a cap on how much can be withdrawn in a year. This cap is part of the LIF’s “locking-in” mechanism. LIRAs and LIFs are “locked-in” since they contain money that came from an RPP, and an RPP is intended to pay a pension for life. The LIF’s cap on withdrawals ensures that the LIF will last and not be depleted.

For members of RPPs whose employment rights are governed federally instead of provincially, LIFs and restricted life income funds (RLIFs) are available. An RLIF is also a special RRIF whose funds are “locked-in”, and which imposes a cap on how much can be withdrawn in a year. The main difference between a LIF and an RLIF is that, within 60 days of establishing an RLIF, up to 50% of the RLIF funds can be unlocked and transferred to an RRSP or RRIF.

In Saskatchewan, LIFs are no longer available. Instead, money from a LIRA can be transferred to a prescribed RRIF (PRIF). Like a RRIF and a LIF, a PRIF has a minimum amount that must be withdrawn each year. However, its funds are not locked-in.

In Newfoundland, LIFs and locked-in retirement income funds (LRIFs) are available. An LRIF is also a special RRIF whose funds are “locked-in”, and which imposes a cap on how much can be withdrawn in a year.

In several Canadian jurisdictions, you must have reached a certain age before you can convert a LIRA. You can open a self-directed LIF (RLIF, PRIF or LRIF) with RBC Direct Investing once you have reached that age.

The following locked-in plans are available at RBC Direct Investing:

- Life Income Fund (LIF): A locked-in savings account that’s similar to a RRIF. A LIF can be funded by a pension plan, a Locked-In Retirement Account (LIRA) or a Locked-In Retirement Savings Plan (LRSP). There's a minimum withdrawal requirement each year, but unlike RRIFs, there's also a maximum annual withdrawal amount.

- Restricted Life Income Fund (RLIF): Available to terminated registered pension plan members whose entitlements are governed by the federal Pension Benefits Standards Act, 1985. An RLIF has withdrawal requirements and 50% of its value can be unlocked and transferred to an RRSP or a RRIF within 60 days of the account being opened if the member is at least 55 years old when the RLIF is opened.

- Locked-in Retirement Income Fund (LRIF): An income fund that’s only available in Newfoundland and Labrador. It’s similar to a LIF, with the same minimum withdrawal rules, but a different calculation for maximum payments. It can also continue throughout your lifetime, with no requirement to convert to a life annuity at a certain age.

- Prescribed RRIF (PRIF): An income fund available in Manitoba and Saskatchewan that’s similar to a RRIF but with no maximum withdrawal requirements.

- Locked-In Retirement Account (LIRA): If you switched jobs from a federally or provincially regulated industry or occupation you may be able to transfer funds/assets from a registered pension plan to a LIRA. You can't make contributions to a LIRA or withdraw money from it until you reach the minimum pension age.

- Restricted Locked-In Savings Plan (RLSP): A locked-in version of a Registered Retirement Savings Plan (RRSP). If you switched jobs from a federally regulated industry or occupation you may be able to transfer funds/assets from a registered pension plan to an RLSP. You can't make contributions to an RLSP or withdraw money from it until you reach the minimum pension age.