Act on Your Advanced Investing Strategies

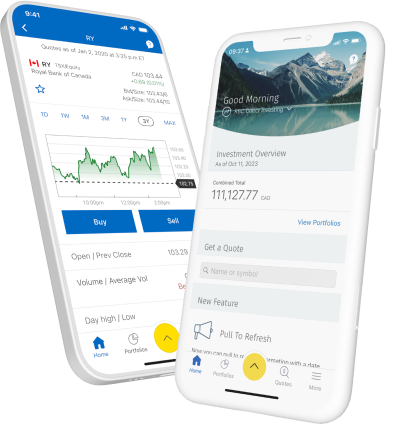

Filter, research and trade options on all three trading platforms, including the RBC Mobile app

Purchase call and put options, write covered calls and, with special exception, write naked puts

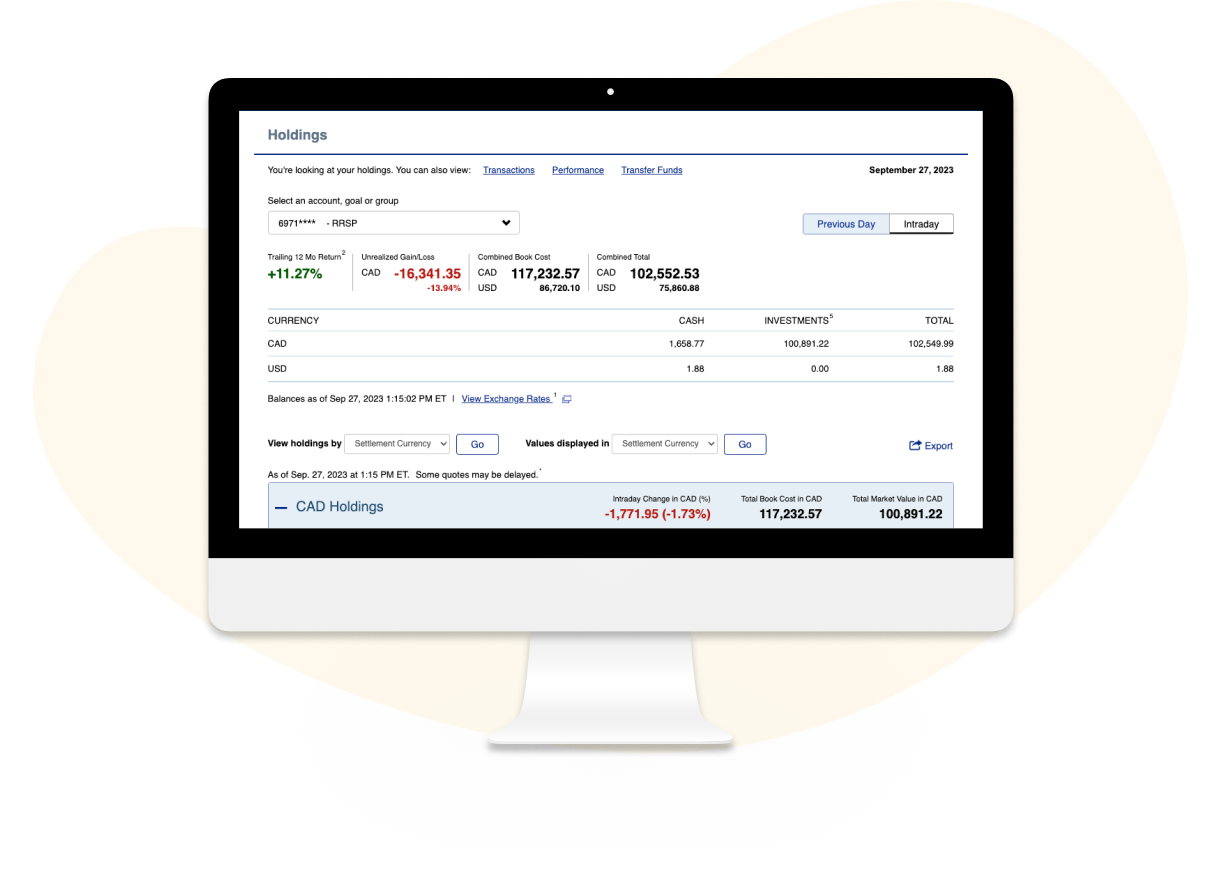

Hold options in a range of accounts, including a TFSA, FHSA, RRSP, cash or margin account

Track stock and ETF prices in the moment with free real-time streaming quotesLegal Disclaimer footnote 2

Analyze detailed options metrics, including Greeks, in the custom Trading Dashboard

Learn about options using the Options Trading Guide in the Investing Academy

Practice trading options and more

Use a risk-free Practice Account to try out the Online Investing platform and experiment with options trading before you commit real money. Free for RBC Royal Bank and RBC Direct Investing clients.

Explore Practice Accounts

Trade Options Online

See how to research options and place an options order on the Trading Dashboard:

Get More for Your Money

Pay a flat commission and access real-time streaming quotes, the Trading Dashboard and more at no extra cost:

All Clients—no minimum trade requirements

$9.95 + $1.25 per options contractLegal Disclaimer footnote 3,Legal Disclaimer footnote 4

Clients with 150 or more trades per quarter

$6.95 + $1.25 per options contract

Minimum commission is $43 per transaction.

Canadian and U.S. stock or options transactions with a principal dollar value of $2,000 or less may be placed with an Investment Services Representative for $43.

$35 + $1.75 per options contract

Discover More About Options

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Start Trading Options

Trade options on three powerful platforms.

Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform.

See the GuaranteeOptions FAQs

Options are essentially contracts between two parties that give you the right to buy or sell an underlying asset at a certain price within a specific amount of time.

An option's value is tied to the underlying asset, which could be stocks, bonds, currency, interest rates, market indices, exchange-traded funds (ETFs) or futures contracts. Options are securities themselves, like a stock or bond, and because they derive their value from something else, they're called derivatives.

There are two main types of options contracts: calls and puts. Owning a call gives you the right to buy the underlying asset; owning a put gives you the right to sell that underlying asset. An easy way to keep them straight is to remember that a call would "call" an asset away, while a put would "put" it to someone else.

Options can support a variety of profit and risk-minimization strategies. In the case of stocks, for instance, options can help you:

- Protect stock holdings from a decline in market price

- Generate income from your existing portfolio

- Acquire stock at a price below the current price

- Profit from a stock price's rise or fall

You can purchase call options and put options, write covered calls and, with special exception, write naked puts. Additional spread strategies are not allowed.