What is an ETF?

ETF means an exchange-traded fund. It’s often a diversified investment fund that could contain a variety of assets—such as stocks, bonds, or commodities. ETFs trade on major stock exchanges throughout the day, and can provide cost-efficient diversification by tracking specific market indices, sectors, or commodities (e.g., oil). Prices fluctuate in real-time based on market activity and the value of the underlying holdings.

Hit that Buy or Sell Button with Confidence

Get analyst-built lists of ETFs with pre-defined screeners by LSEGLegal Disclaimer footnote ‡ or search ETFs with your own filters

Keep an eye on ETFs you like and track the ones you hold with alerts and watchlists

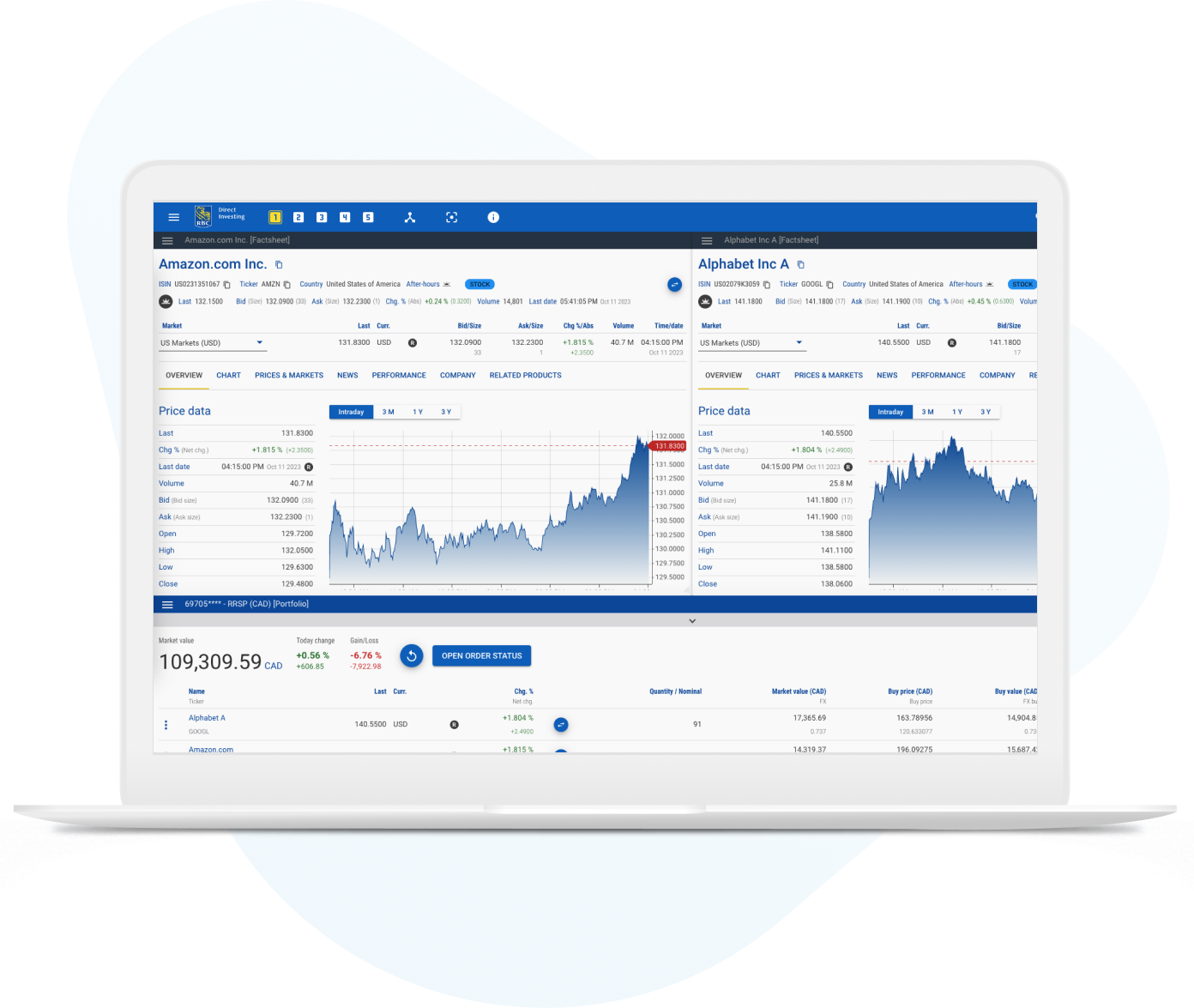

Track ETF prices in the moment with free real-time streaming quotesLegal Disclaimer footnote 1

Stay ahead of the markets with online and mobile pre-market and after-hours trading at no extra cost

Hold ETFs in CDN or US dollarsLegal Disclaimer footnote 2 in a range of accounts, including a TFSA, FHSA, RRSP, cash or margin account

Automatically re-invest cash dividendsLegal Disclaimer footnote 3 to buy additional shares commission-free

Practice investing in ETFs and more

Use a risk-free Practice Account to try out the Online Investing platform and experiment with placing trades before committing real money. Free for RBC Royal Bank and RBC Direct Investing clients.

Explore Practice Accounts

A new, smart

way to invest.

Introducing GoSmart by RBC Direct Investing, designed for new investors and built to make investing easy.

Explore moreInvest in ETFs Online and On the GoLegal Disclaimer footnote 4

See how to buy and sell ETFs on all three platforms:

Get to know the RBC Direct Investing Site

Transferring Stocks and ETFs Into Your Account

Get to Know the RBC Direct Investing Mobile AppLegal Disclaimer footnote 6 Experience

How to Place an Order in the RBC Mobile App

How to Place Stock and ETF Orders in the Trading Dashboard

How to Search for a Quote in the Trading Dashboard

Get More for Your Money

Pay a flat commission and get income projection, real-time streaming quotesLegal Disclaimer footnote 1 and online and mobile pre-market and after-hours trading at no extra cost.

All Other ETFs

Less than 150 trades/quarter: $9.95 per online/mobile tradeLegal Disclaimer footnote 8, Legal Disclaimer footnote 9

150+ trades/quarter: $6.95 per online/mobile tradeLegal Disclaimer footnote 8, Legal Disclaimer footnote 9

| ETF Price | Commission Rate* |

|---|---|

| $0.00 - $0.50 | 2.5% of trade |

| $0.51 - $2.00 | $35 + $0.02 per share |

| $2.01 and over | $35 + $0.05 per share |

*Minimum commission is $43 per transaction.

Discover More About ETFs

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage.Legal Disclaimer footnote 10 (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.Legal Disclaimer footnote 11)

ETFs FAQs

Think of exchange-traded funds (ETFs) as a variety pack of stocks, bonds and other investments that can add diversification to your portfolio without the same price tag as purchasing the investments individually. ETFs trade on major stock exchanges throughout the day, and the investments in them track specific market indices, sectors or commodities (such as oil).

ETF shares, or units, can be bought and sold on a stock exchange throughout the trading day, just like stocks. They are a one-stop shop for purchasing an underlying asset or asset class.

An ETF's underlying securities are largely determined by the investment objective of the ETF. Some common underlying assets include stocks, bonds, commodities and currencies.

ETFs are open-ended, meaning units can be created or redeemed based on investor demand. This process is managed by market makers. A market maker is a trader at a bank or brokerage tasked with making firm bids or offers to ensure liquidity is maintained in the market.

An ETF listed for trading on a Designated Stock Exchange (DSE) is a qualified investment for registered plans. A DSE includes the TSX and other Canadian and U.S. exchanges. You can find a list of DSEs by visiting www.canada.ca and searching "designated stock exchanges."

Exchange-traded funds (ETFs) provide the risks and rewards of the underlying market:

There may be commissions, trailing commissions, investment fund management fees and expenses associated with investment fund and exchange-traded fund (ETF) investments. On or after June 1, 2022, any trailing commissions paid to RBC Direct Investing Inc. will be rebated to clients pursuant to applicable regulatory exemptions. Before investing, please review the applicable fees, expenses and charges relating to the fund as disclosed in the prospectus, fund facts or ETF facts for the fund. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.