Hit that Buy or Sell

Button with Confidence

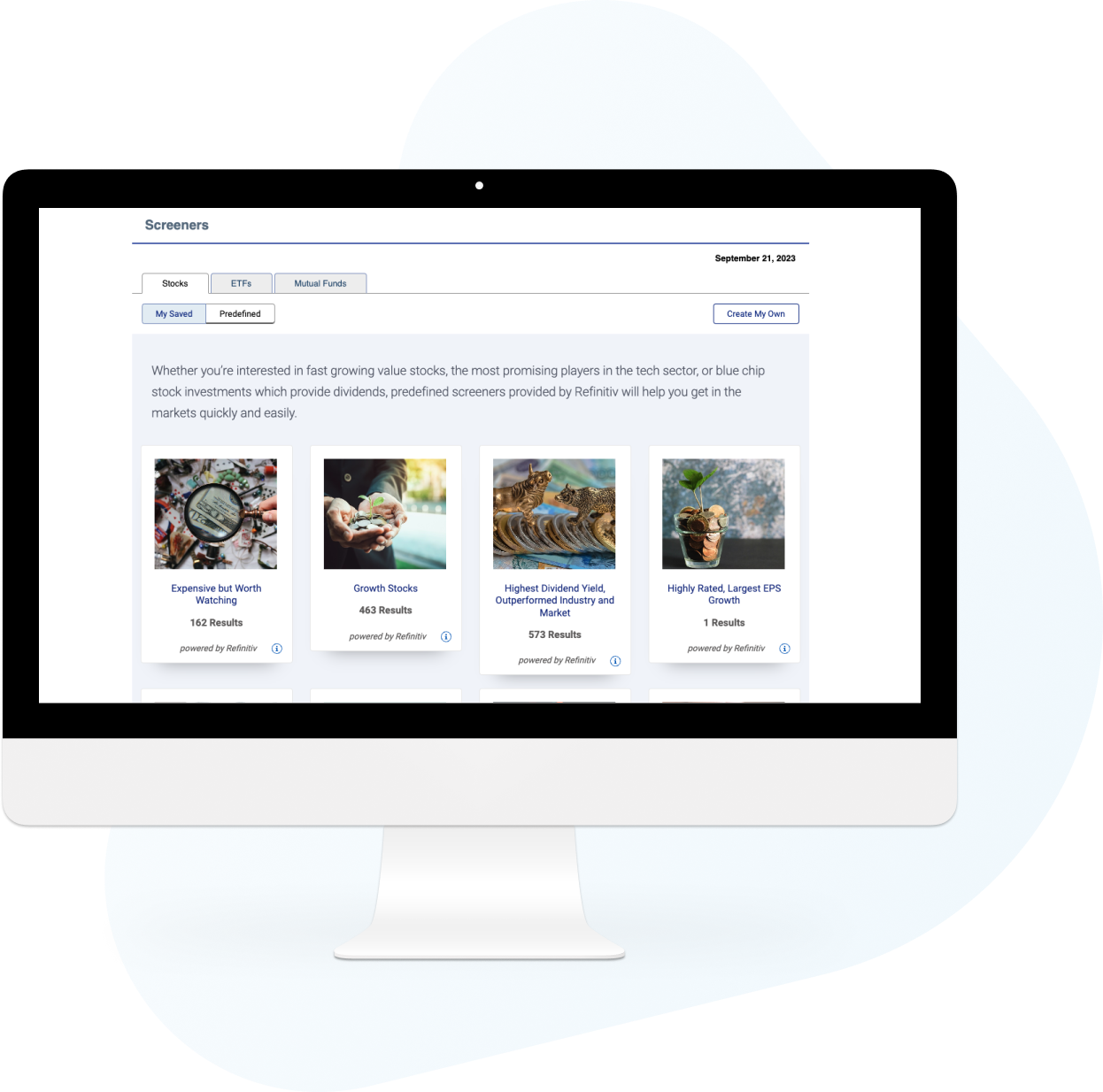

Make informed decisions with tools and research from MorningstarLegal Disclaimer footnote ‡, LSEGLegal Disclaimer footnote ‡ and RBC

Keep an eye on stocks you like and track the ones you hold with alerts and watchlists

Track stock prices in the moment with free real-time streaming quotesLegal Disclaimer footnote 1

Stay ahead of the markets with online and mobile pre-market and after-hours trading at no extra cost

Hold stocks in CDN or US dollarsLegal Disclaimer footnote 2 in a range of accounts, including a TFSA, FHSA, RRSP, cash or margin account

Automatically re-invest cash dividendsLegal Disclaimer footnote 3 to buy additional shares commission-free, then project the income they’ll earn over time

A new, smart

way to invest.

Introducing GoSmart by RBC Direct Investing, designed for new investors and built to make investing easy.

Explore morePractice trading stocks and more

Use a risk-free Practice Account to try out the Online Investing platform and experiment with placing trades before you commit real money. Free for RBC Royal Bank clients

Explore Practice Accounts

Trade Stocks Online and On the GoLegal Disclaimer footnote 4

See how to buy and sell stocks on all three trading platforms:

How to Buy and Sell a Stock on the Online Investing Platform

How to Read a Stock Quote on the Online Investing Platform

How to Manage Orders in the RBC Mobile App

How to Place an Order in the RBC Mobile App

How to Place Stock and ETF Orders in the Trading Dashboard

How to Search for a Quote in the Trading Dashboard

Get More for Your Money with Every Trade

Pay a flat commission and get income projection, real-time streaming quotesLegal Disclaimer footnote 2 and pre-market and after-hours trading at no extra cost:

| Stock Price | Commission Rate* |

|---|---|

| $0.00 - $0.50 | 2.5% of trade |

| $0.51 - $2.00 | $35 + %0.02 per share |

| $2.01 and over | $35 + %0.05 per share |

*Minimum commission is $43 per transaction.

Discover More About Stocks

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage.legal disclaimer 7 (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.legal disclaimer 8)

Stocks FAQs

A stock (also called an equity or share), is an investment that lets you own part of a public corporation and may allow you to vote on key decisions about its future. Stocks let you take part in a company’s gains—like and potential income—and losses, too.

When you buy a stock, you are participating in the future gains (like and potential income) and losses of the company that has issued the stock. Stocks are considered a higher-risk investment than fixed-income investments like guaranteed investment certificates (GICs), so investors tend to expect a higher rate of return in exchange for that risk.

Companies issue stock so they can raise money to run and grow the business. Every share in the company's stock represents a small part of the company's assets and earnings. The total value of stock held by the public is known as the company's market capitalization, or market cap.

At RBC Direct Investing, you can place orders to buy and sell stocks on our Online Investing platform, the RBC MobileLegal Disclaimer footnote 6 app and the Trading Dashboard. You can also place orders by phone with an investment services representative.

If you're comfortable with fluctuating returns, stocks offer a variety of benefits, including:

- Potential for superior long-term returns compared to cash and fixed-income investments

- Potential to earn dividends and capital gains

Yes, you can hold stocks in a TFSA, FHSA, RRSP, RRIF or RESP, so long as they are qualified investments (opens in new window).

If you choose to hold foreign investments in your TFSA or RESP, many governments — including the U.S. — apply a non-resident withholding tax to foreign-source income received. Withholding taxes are unrecoverable, and may reduce your potential returns. For example, the IRS imposes a 30% withholding tax to dividends paid on U.S. stocks, which can be reduced to 15% by submitting a W-8BEN or W-9 form. Check with your tax advisor to learn more.

There are several ways to search for a stock:

- Online Investing platform: Log in to your account and enter the stock symbol or company name in the quote search bar at the top of the screen.

- RBC Mobile app: Log in to your RBC Direct Investing account and enter the stock symbol or company name under Get a Quote.

- Trading Dashboard: Enter the stock symbol or company name in the quote search bar at the top of the screen. You can also use the Quote widget.