Tools in the Spotlight

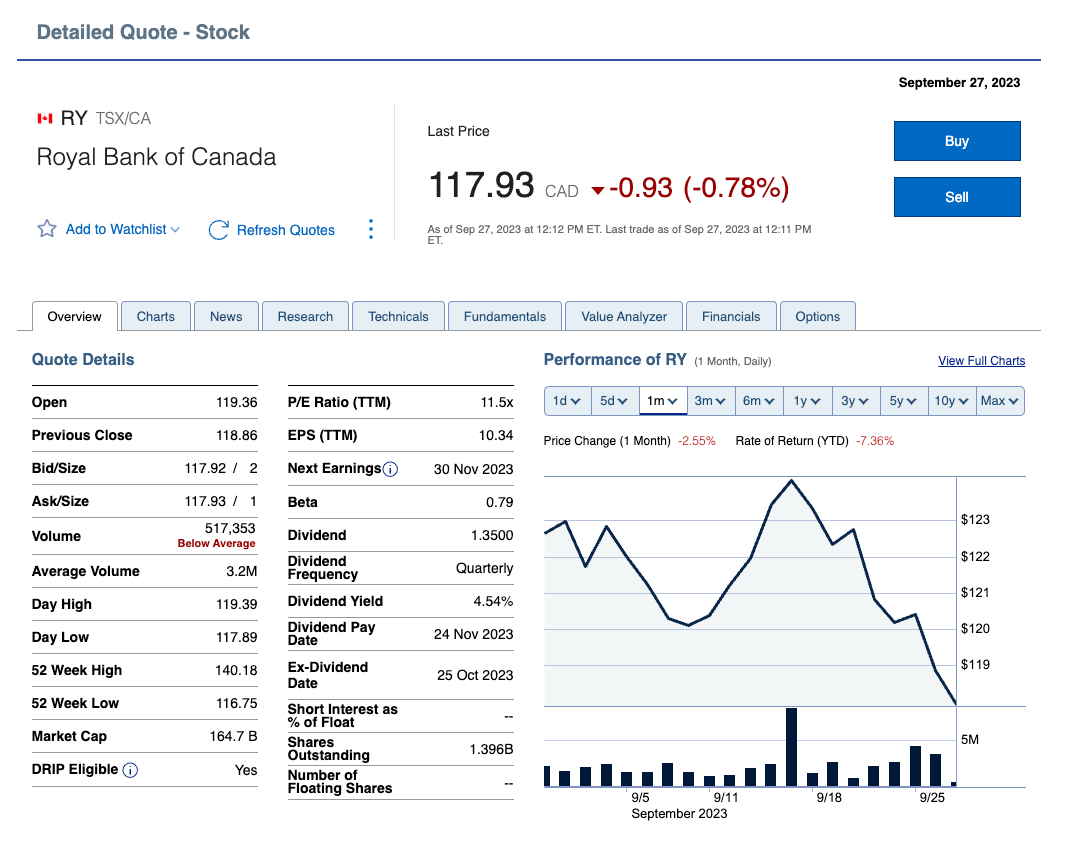

Real-time streamingLegal Disclaimer footnote 1 quotes

Track stock and ETF prices in-the-moment without having to pay extra.

Learn More about real-time streaming quotes

Event-driven insightsLegal Disclaimer footnote 2 for your portfolio

Discover how real-world situations and events are impacting your investments.

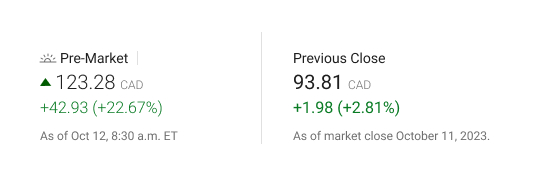

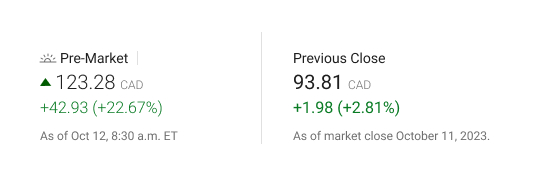

Pre-market and after-hours trading

Get your hands on up-to-the-minute data, even after the closing bell rings.

Learn More about pre-market and after-hours trading

Tools that Empower. Research that Informs.

Learn and Explore at Your Own Pace

Take baby steps—or dive right in—with resources that are designed to help you take control. You can even talk to an investment services representative if you have a question or need help getting started.

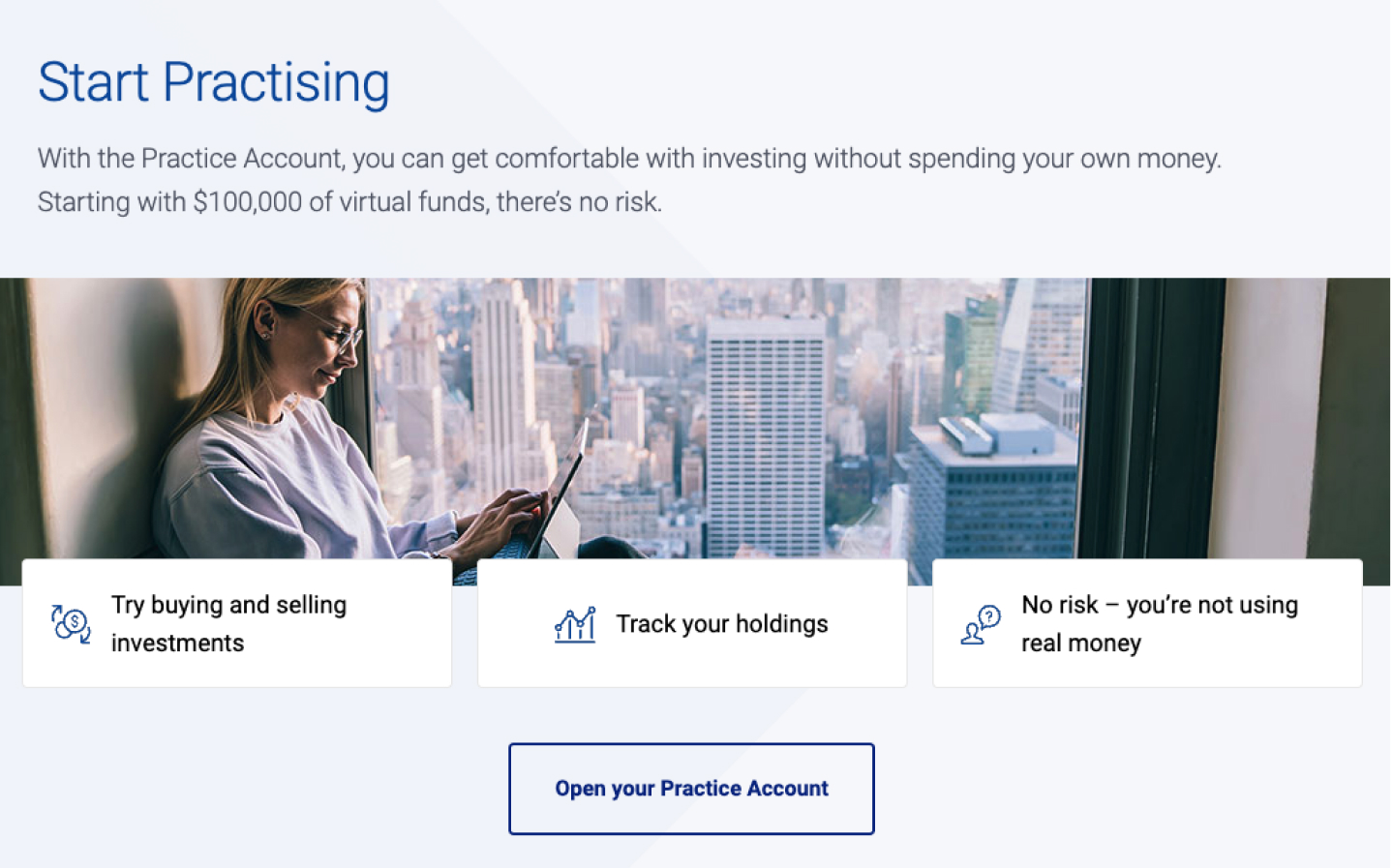

Practice Trading Stocks and More

Get comfortable using the Online Investing platform with guest access through a Practice Account. Free for RBC Online Banking and RBC Direct Investing clients.

Build Your Knowledge with Inspired Investor Trade

Get insights to support your decisions and explore the Investing Academy for guides on topics like investing in stocks, options and more.

Get Started with the Investor's Toolkit

When you're a new investor, it can be hard to know where to begin. The Investor's Toolkit can help by showing you the basics you need to build your strategy and start investing.

Watch and Learn

See how to buy a stock on the Online Investing platform, learn how to manage watchlists on the RBC MobileLegal Disclaimer footnote 3 app, and more with educational videos and demos.

Find Opportunities and Validate Your Ideas

From analyst-built stock screeners to world-class research, find everything you need to build your portfolio.

Easily Search Thousands of Investments

Look up a company or stock symbol in the RBC Mobile app. Quickly find stocks, ETFs, mutual funds, GICs, bonds and more using powerful screeners and search tools on the Online Investing platform and Trading Dashboard.

Get analyst-built lists of stocks and more with pre-defined screeners on the Online Investing platform.

Analyze sectors and industries to find companies to invest in on the Online Investing platform.

Easily find GICs, bonds, T-Bills and more on the Online Investing platform.

Search for a company name or stock symbol from the RBC Mobile app.

View new issues to access initial public offerings (IPOs) on the Online Investing platform.

Search for thousands of investments from the Trading Dashboard.

Inform Your Decisions with Extensive Research

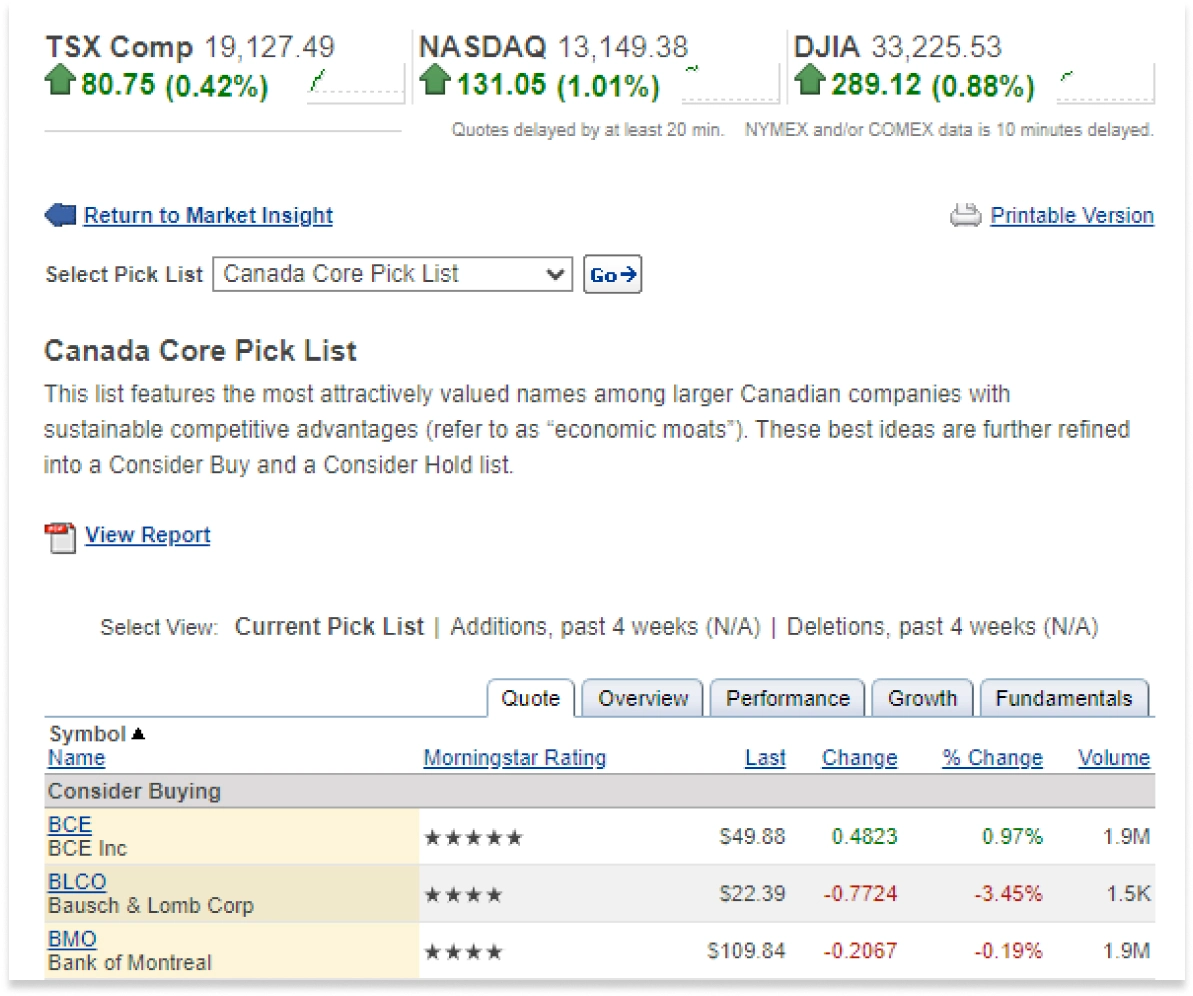

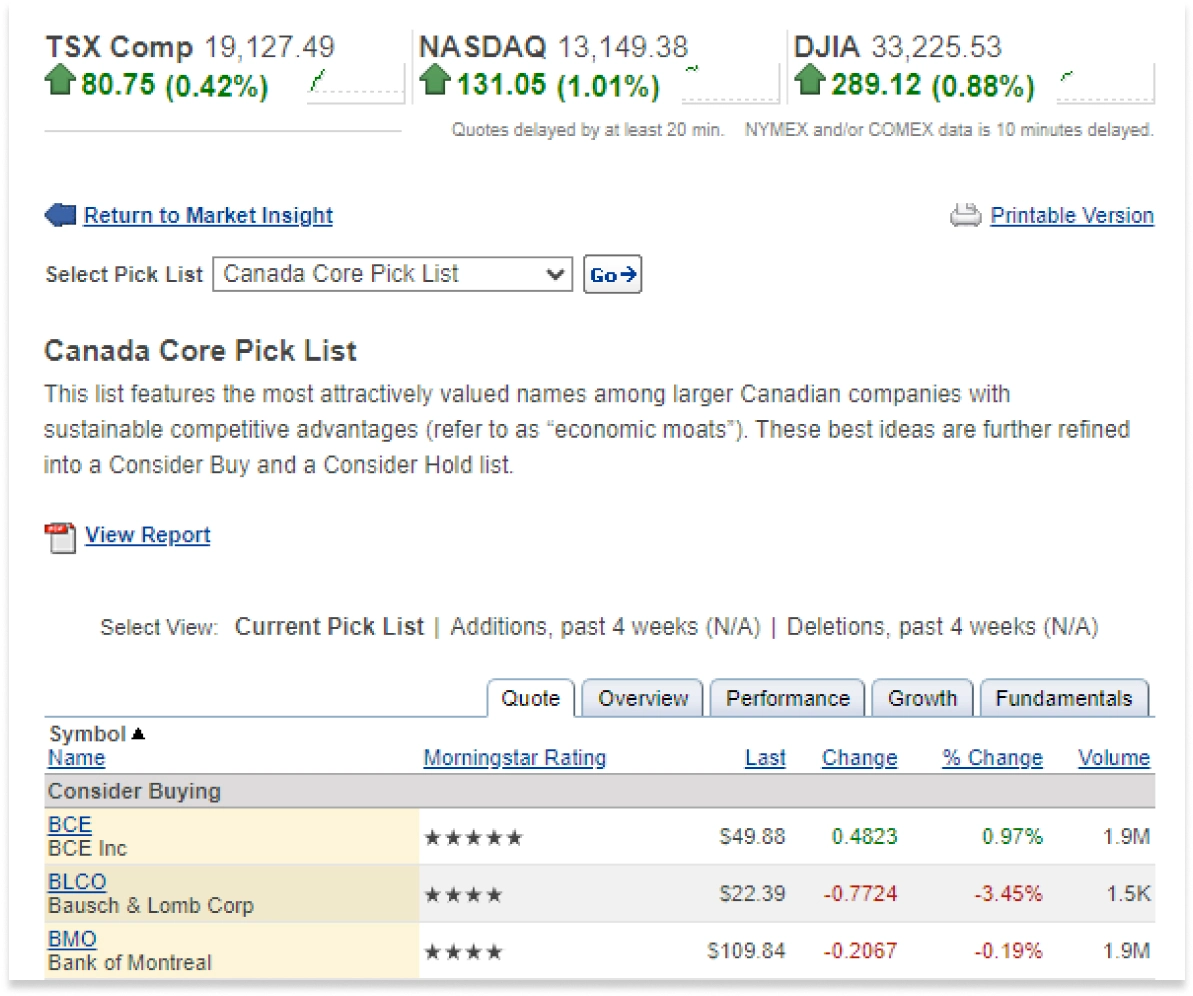

See what analysts are noticing with MorningstarLegal Disclaimer footnote ‡ Pick Lists, explore analyst upgrades and downgrades from RefinitivLegal Disclaimer footnote ‡ and access expert market commentary from Morningstar and RBC.

Morningstar's research reports, tools and ratings can help you make informed investment decisions, whether you need to evaluate your choices or understand the performance of your investments.

- Morningstar Pick Lists: Explore investment ideas or build your portfolio with stock-based pick lists and ETF analyst favourites.

- Morningstar Ratings: See whether Morningstar rates a stock as overvalued, fairly valued or undervalued or assess a fund’s past performance relative to its peers.

- Morningstar Research Reports: Access Canadian Research Highlights, Stock and ETF Reports, and Editorials by Morningstar investment professionals.

RBC draws on a vast global network of investment and research professionals to deliver knowledge and insights that can help inform your investment decisions:

- Equity Benchmark Performance Reports: Get a monthly summary of the performance of stock market indices and sub-indices from RBC Capital Markets.

- RBC Economics: Access economic updates and forecasts, housing reports, exclusive podcasts and more for Canada, the U.S. and key global markets.

- Global Insight Daily: Get reviews of equity, fixed income, commodity and currency markets by analysts and strategists at RBC Capital Markets and RBC Wealth Management.

- Expert Insights and Global Investment Outlook: Find regular articles and quarterly insights provided by senior investment professionals at RBC Global Asset Management.

Keep an Eye on Investments You’re Interested in with Watchlists

Track the activity of stocks, ETFs, options and more in up to 40 custom watchlists of up to 100 securities each. Watchlists are available on all three trading platforms so you can see the action throughout the trading day.

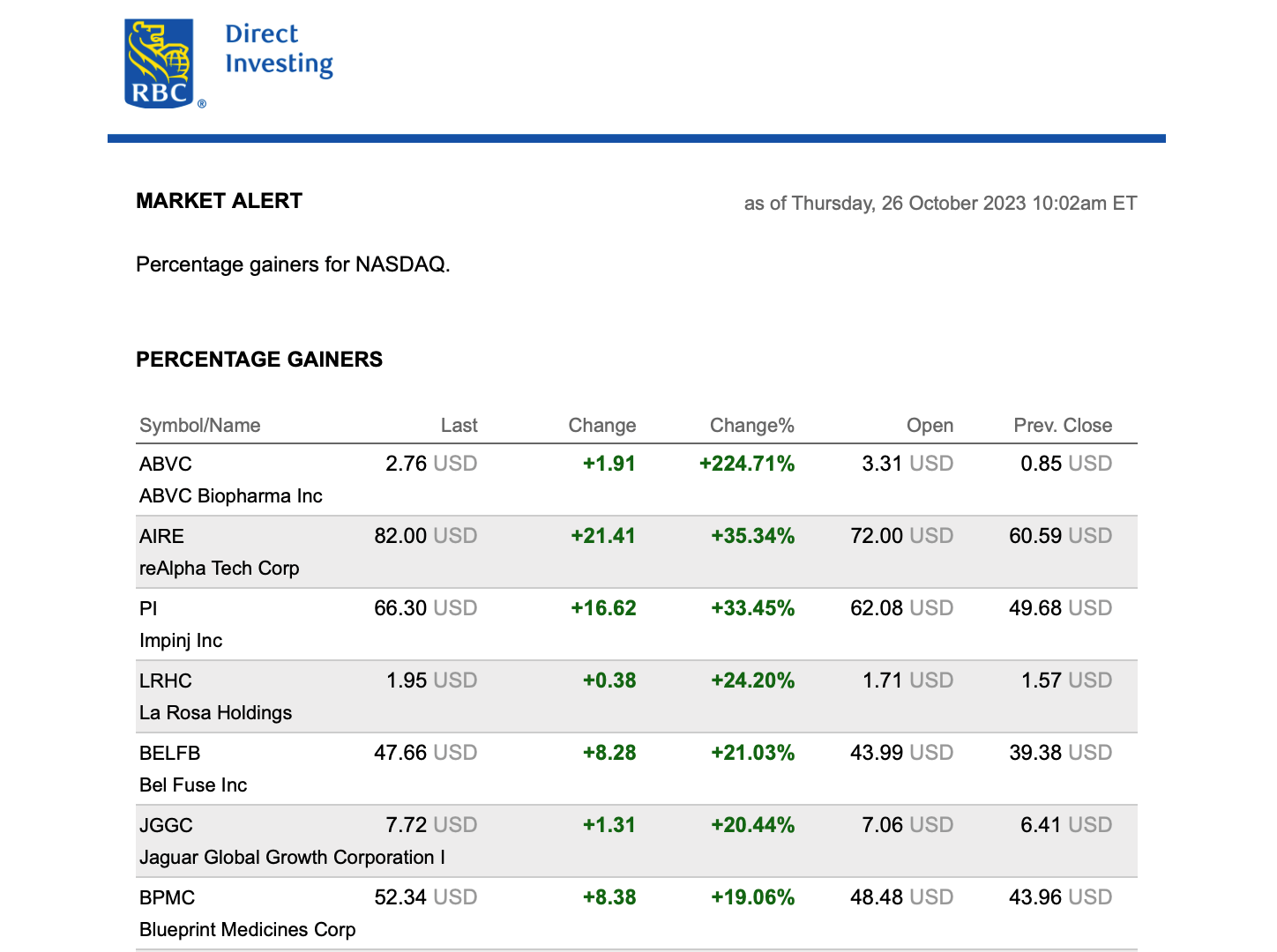

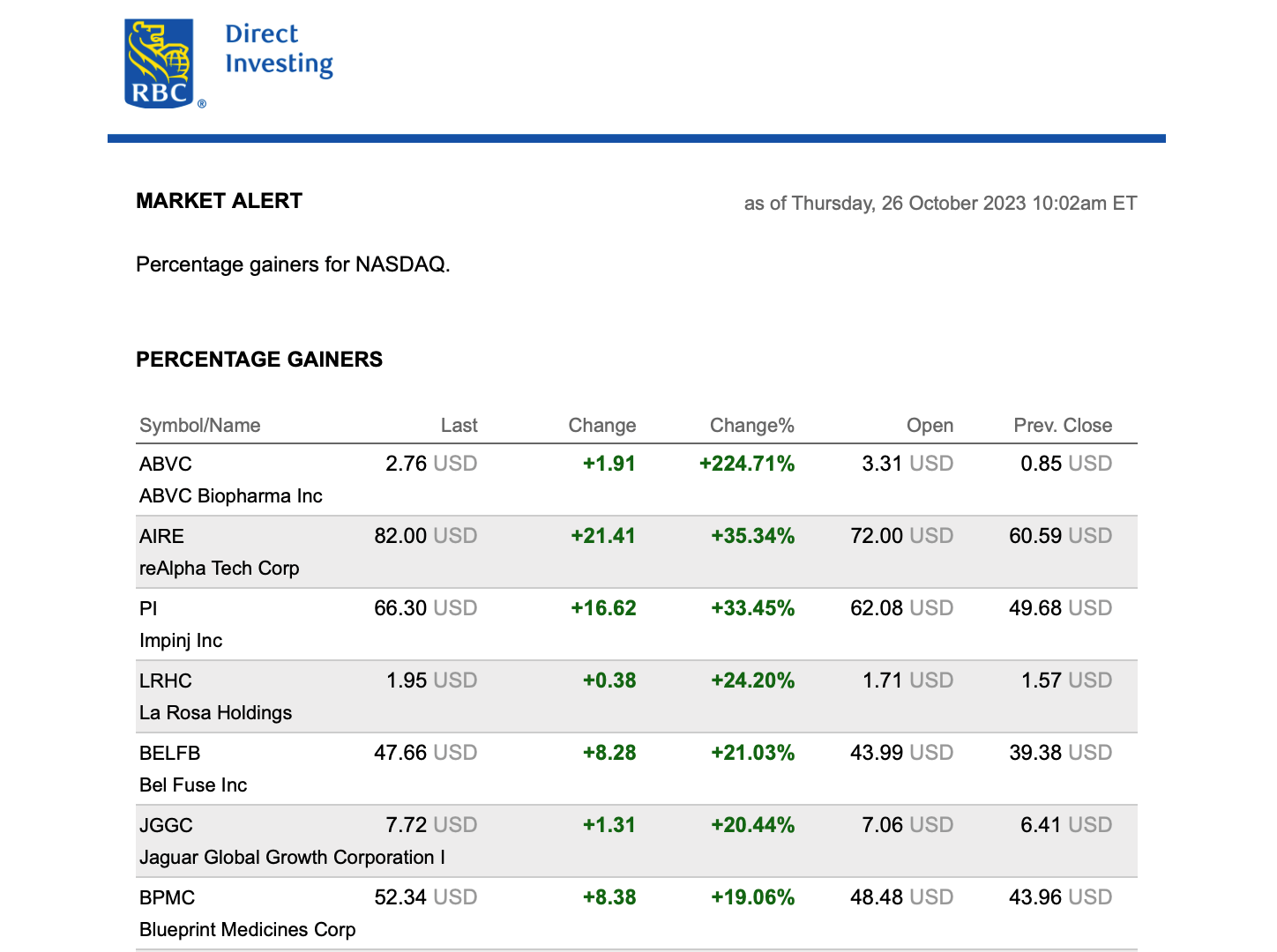

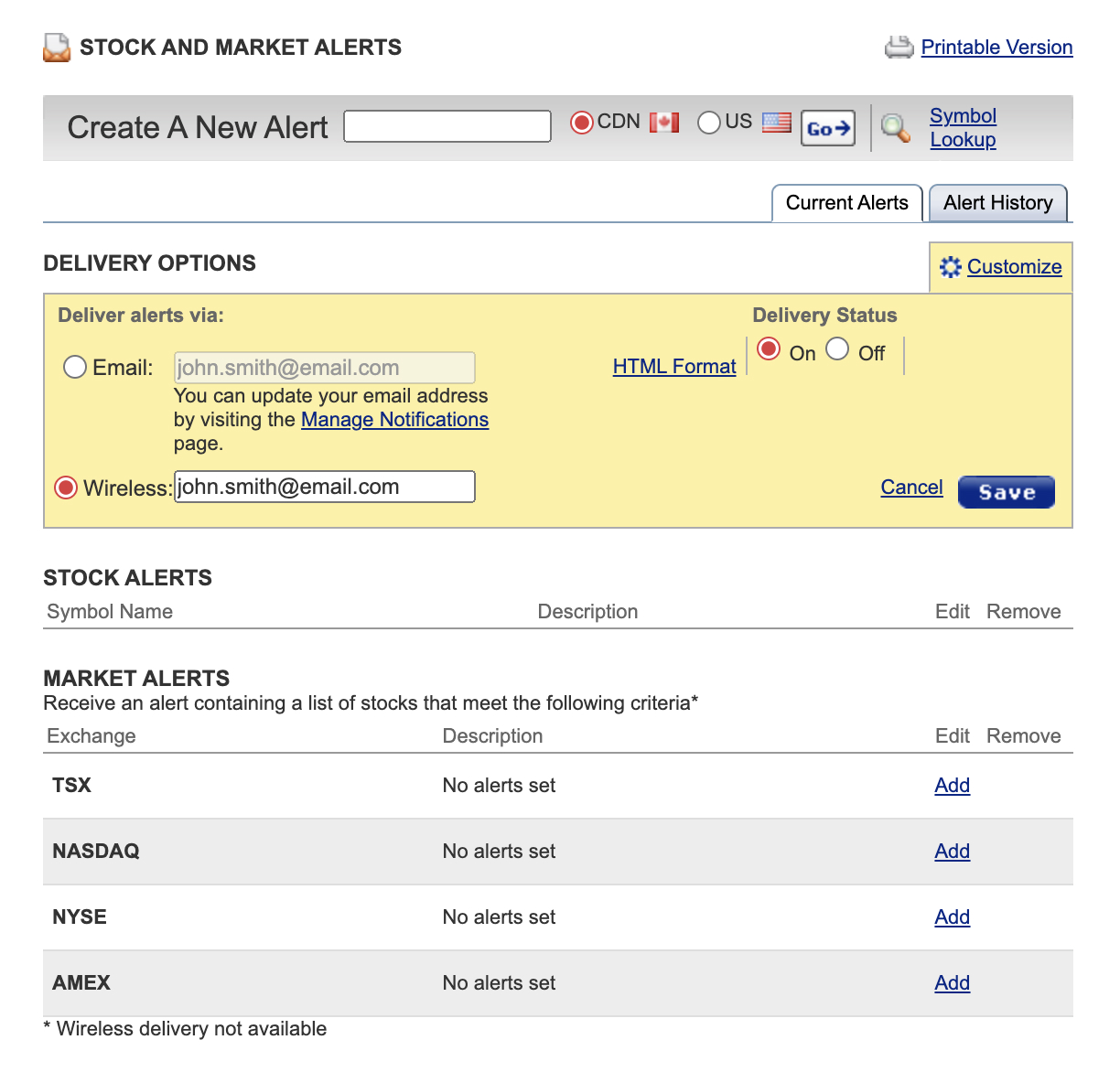

Get Stock and Market Alerts on All Your Devices

Set alerts for stock price movements, specific news, Morningstar reports, and events or price changes on certain exchanges—such as the Toronto Stock Exchange (TSX) or New York Stock Exchange (NYSE).

Identify Trends and Analyze Patterns to Inform Your Stock Trades

Take your trading to another level with technical analysis and advanced charting tools from Trading CentralLegal Disclaimer footnote ‡, FactSetLegal Disclaimer footnote ‡ and S&P Global Market IntelligenceLegal Disclaimer footnote ‡.

Spot trends, confirm decisions and more with technical analysis in the Online Investing platform.

Use the Advanced Charting tool in the Online Investing platform to identify trends and patterns.

Set benchmarks, use drawing tools and view overlays and indicators with the Chart widget in the Trading Dashboard.

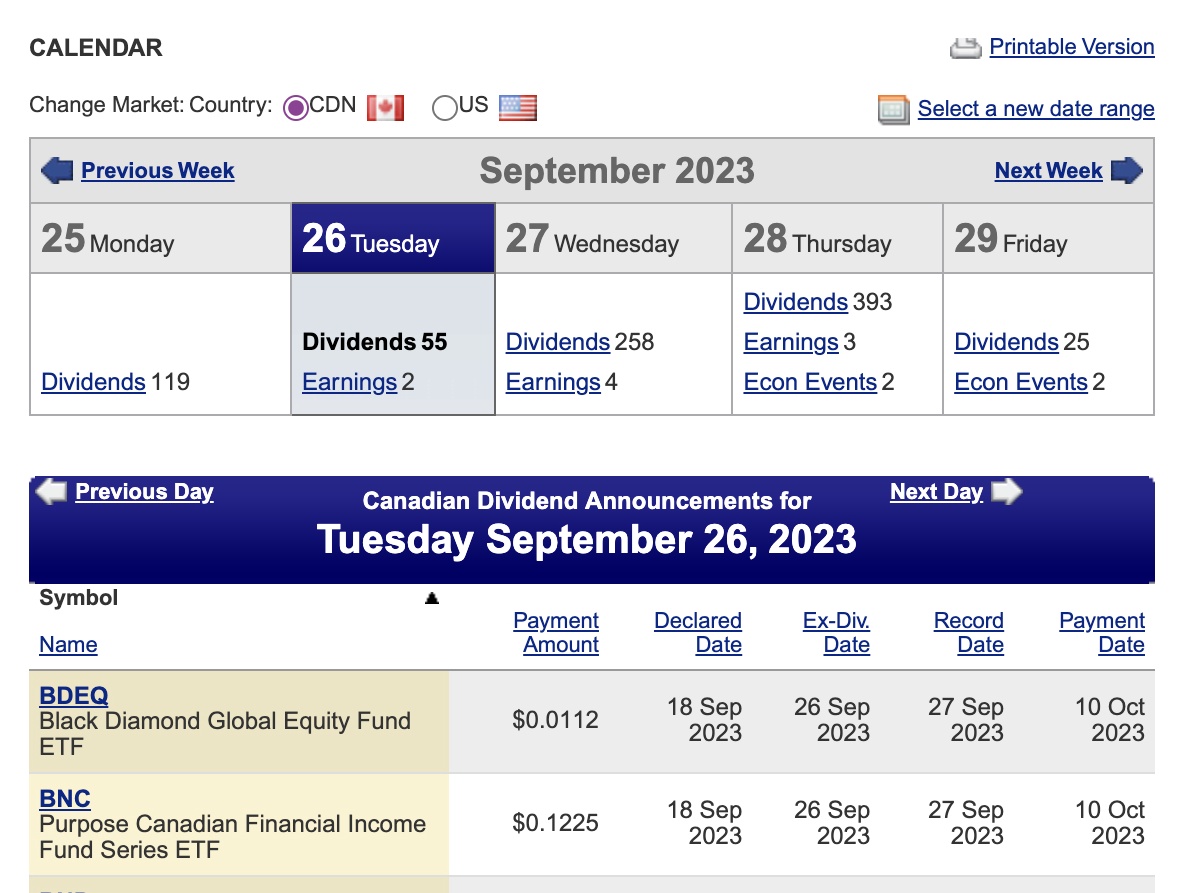

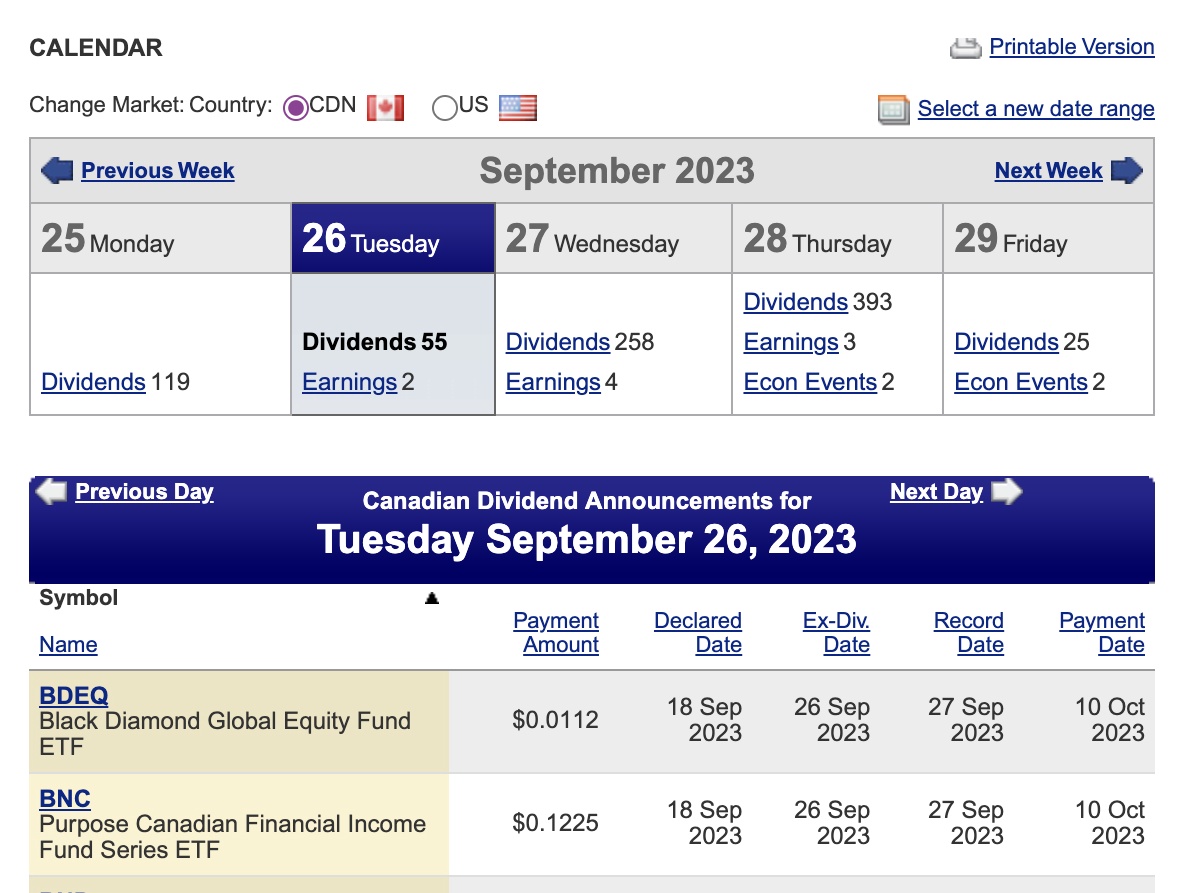

Keep Track of Important Dates

Get daily, weekly and monthly views of economic events, earnings dates and dividend dates for investments you’re interested in using the Earnings and Events calendar.

Stay on Top of News That Could Impact Your Trading Decisions

Filter on categories like stock markets, earnings and more to see the latest news and headlines on the Online Investing platform. You can also view detailed news on the Trading Dashboard.

Invest and Trade in the Moment

Take action with the real-time data you need to make confident decisions.

Make Informed Trades with Real-Time StreamingLegal Disclaimer footnote 1 Quotes

At home or on the go, track stock and ETF prices in the moment with real-time streaming quotes —without having to pay extra.

Stay Ahead with Pre-Market and After-Hours Trading

Trading doesn’t have to stop when the markets close. React to the most current market news with pre-market and after-hours trading, available at no additional cost.

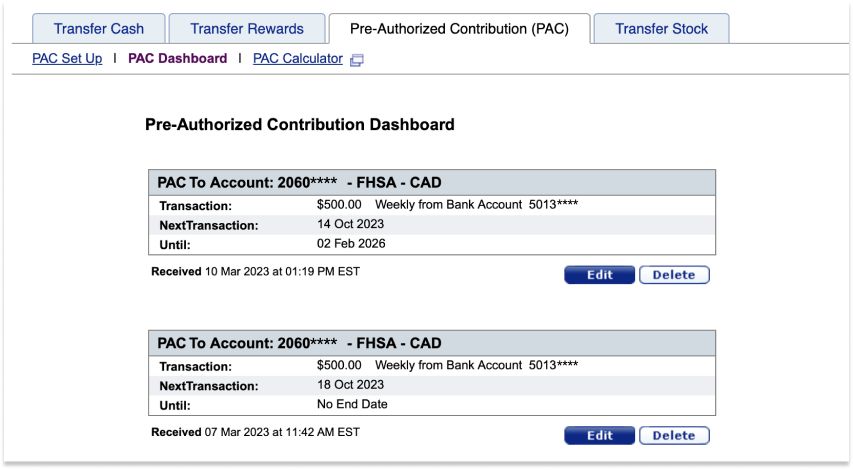

Put Your Savings on Auto-Pilot

Set up a pre-authorized contribution (PAC) to your account(s) in any amount you want and then invest that money when you’re ready. Maintain a PAC of at least $100 per month ($300 per quarter) and we’ll waive the $25 quarterly maintenance fee.Legal Disclaimer footnote 4

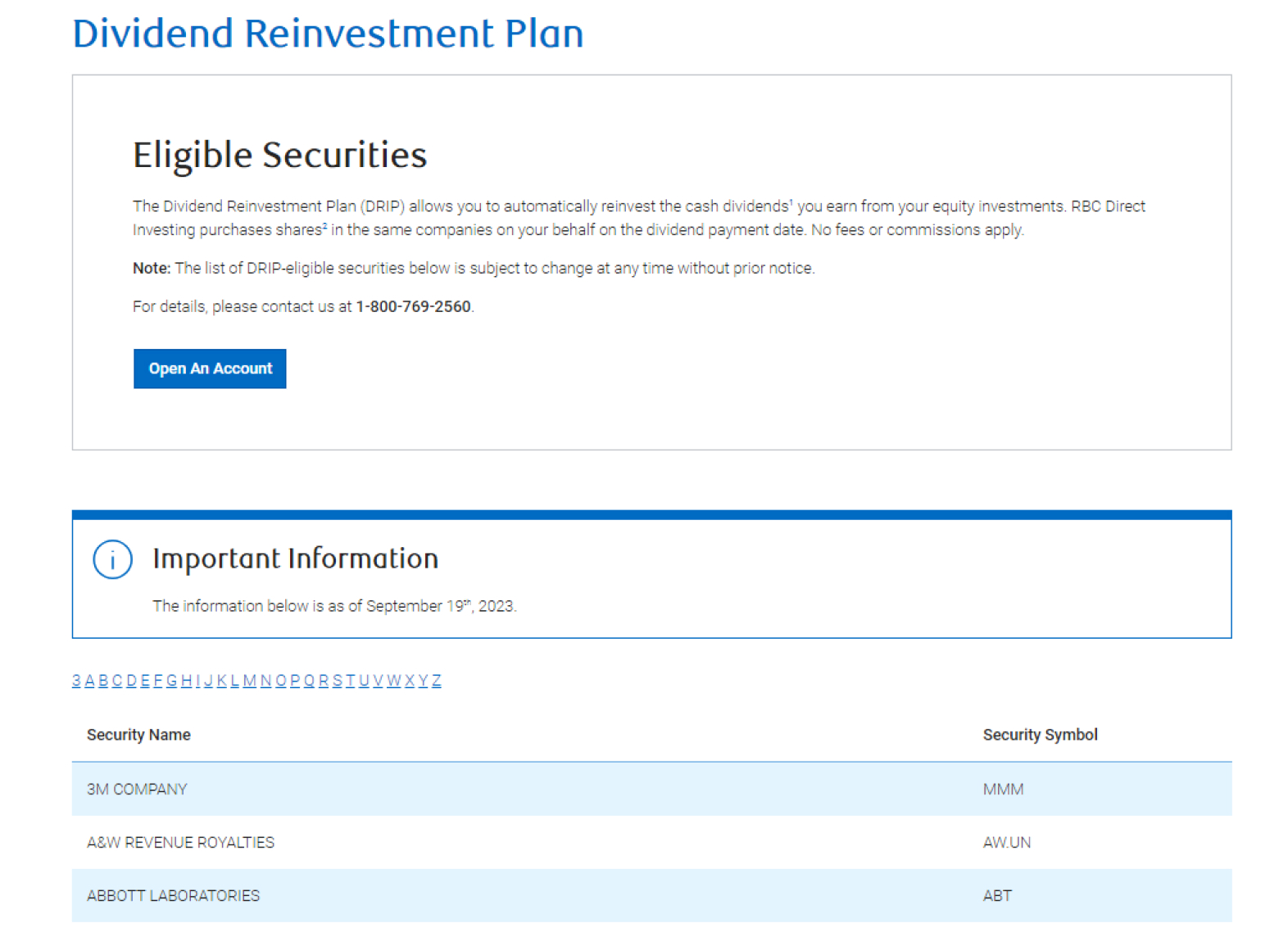

Keep Your Money Invested

- Automatically reinvest cash dividendsLegal Disclaimer footnote 5 earned from your equity investmentsLegal Disclaimer footnote 6 on the dividend payment date. No fees or commissions apply.

- Automatically roll over your treasury bills when they mature, so your T-Bills keep earning all they can (can be set up from the Online Investing platform only).

Track and Manage Your Investments

Keep an eye on your investments and your goals on track.

Get a Snapshot of Your Holdings or Drill Down for Details

View your accounts and holdings in real time, check the status of orders, and choose from a range of options to get details about the holdings in your portfolios.

View your accounts, linked Avion points and exchange rate in the RBC Mobile app.

Quickly view details about your holdings on the Online Investing platform, including intraday activity.

Get an instant overview of your portfolios, alerts and activity on the Trading Dashboard.

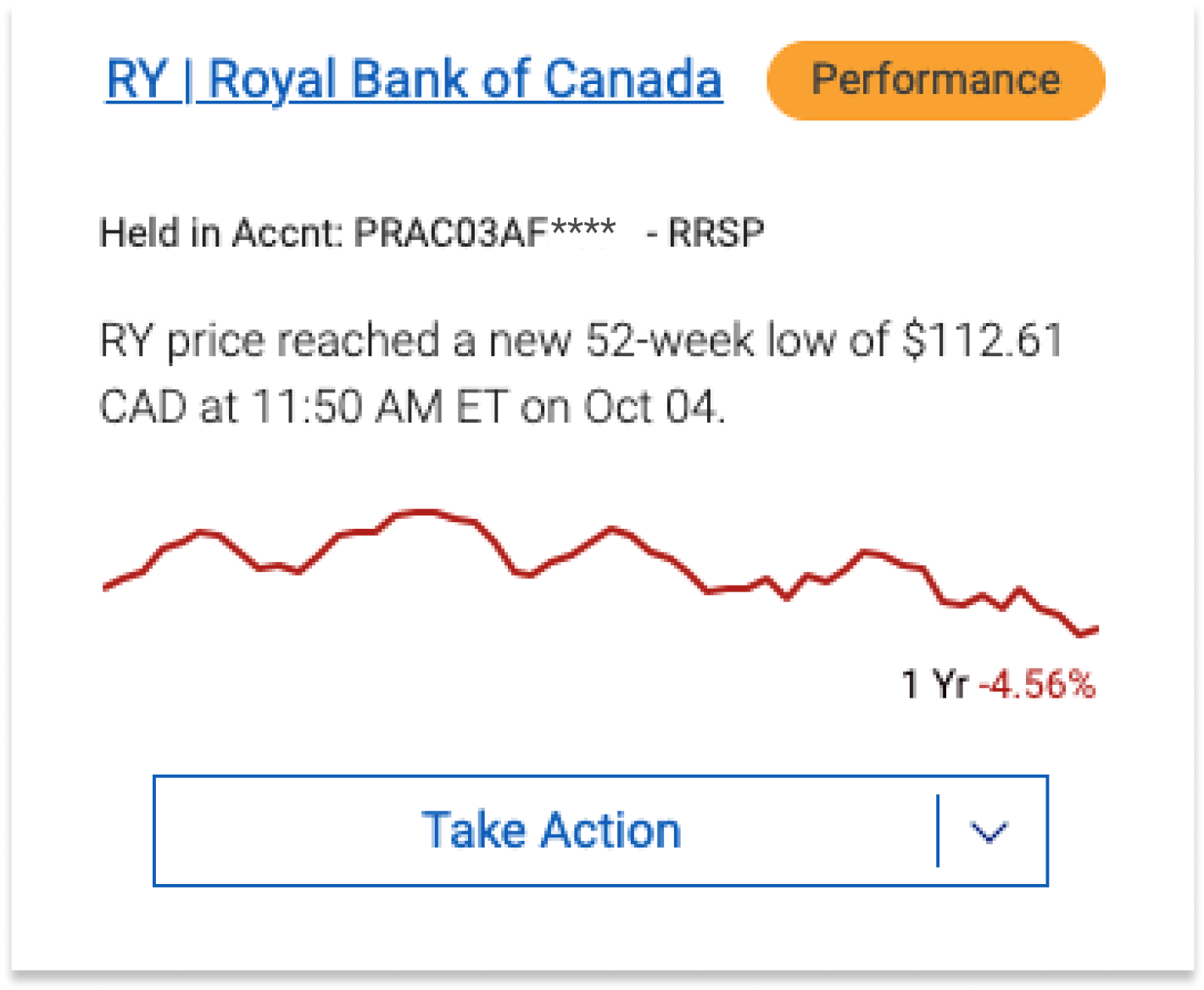

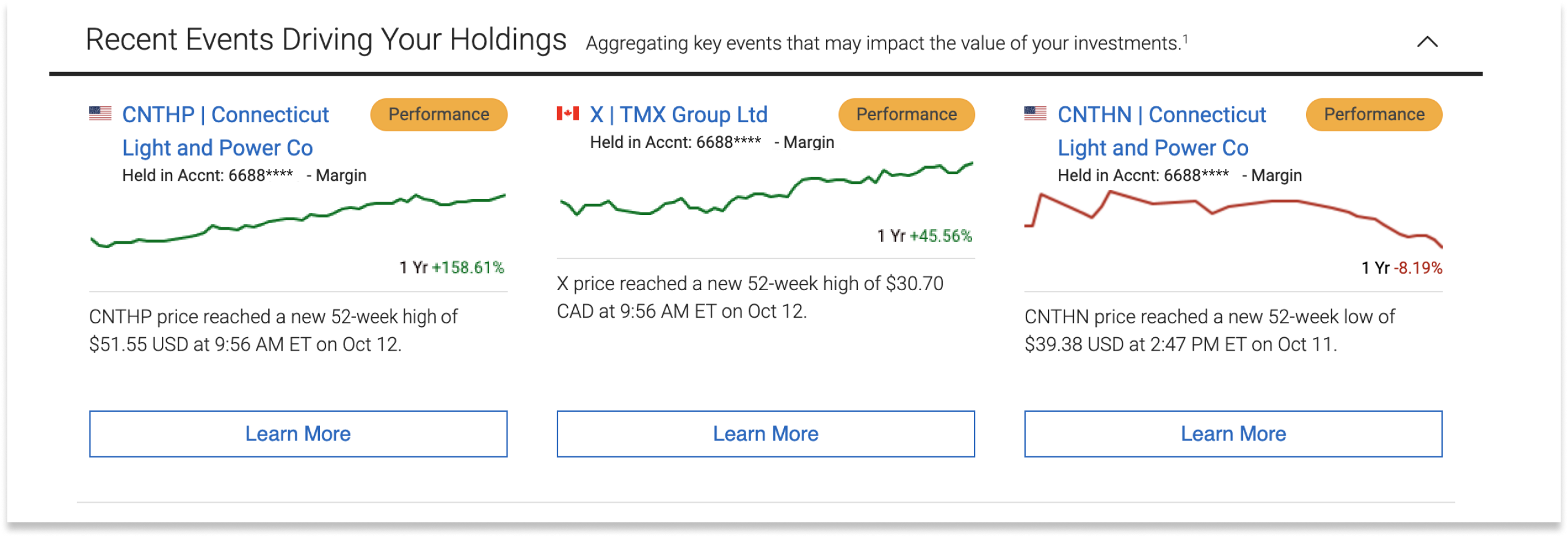

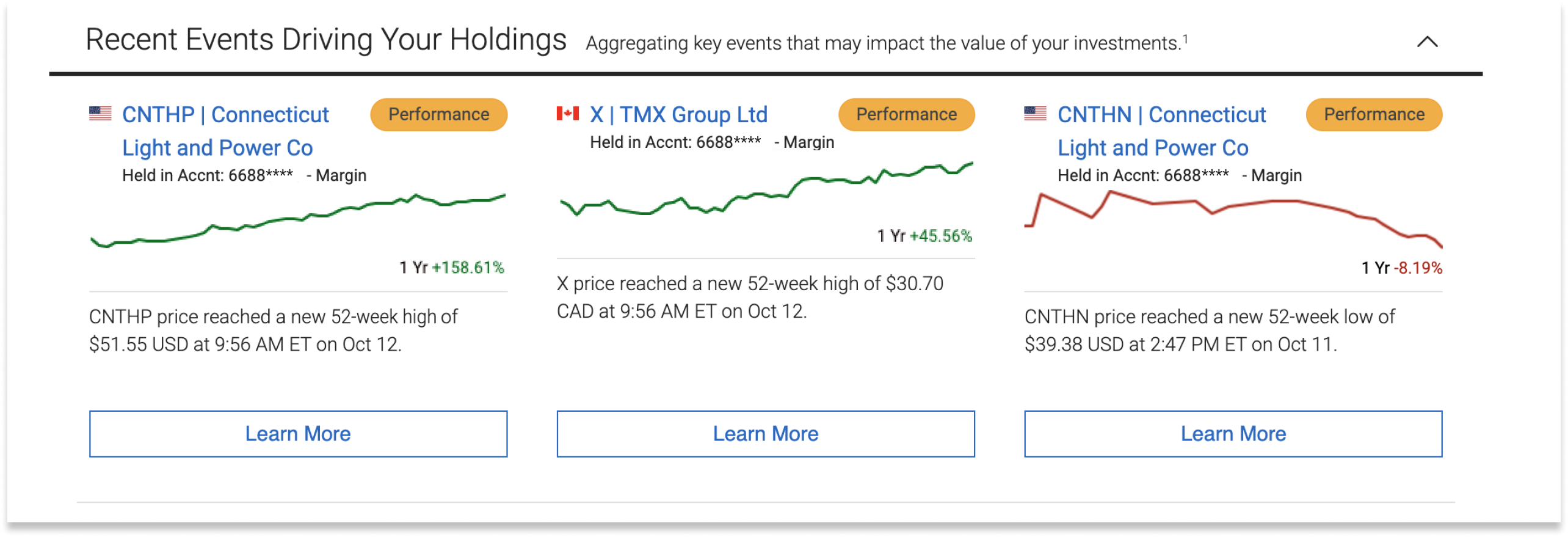

See Recent Events That May Impact the Value of Your Investments

Make informed buy and sell decisions with indicators and trends that are relevant to the securities you hold. Insights include dividend announcements, earnings, 52-week highs/lows and more.

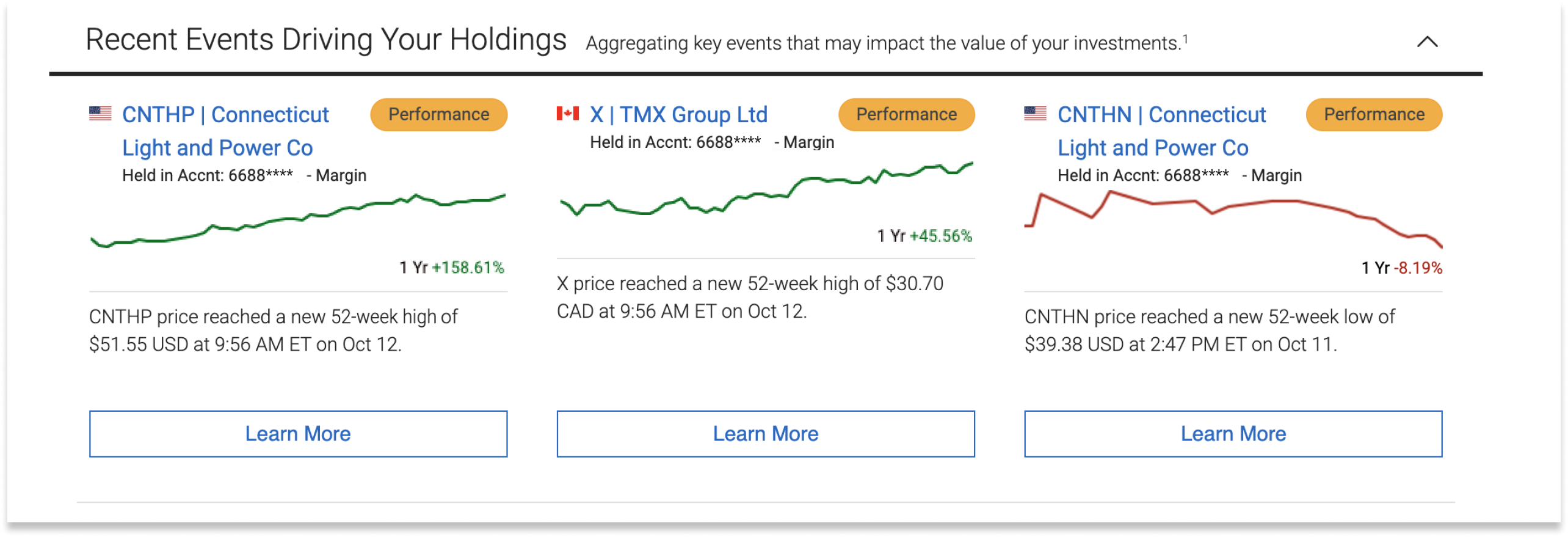

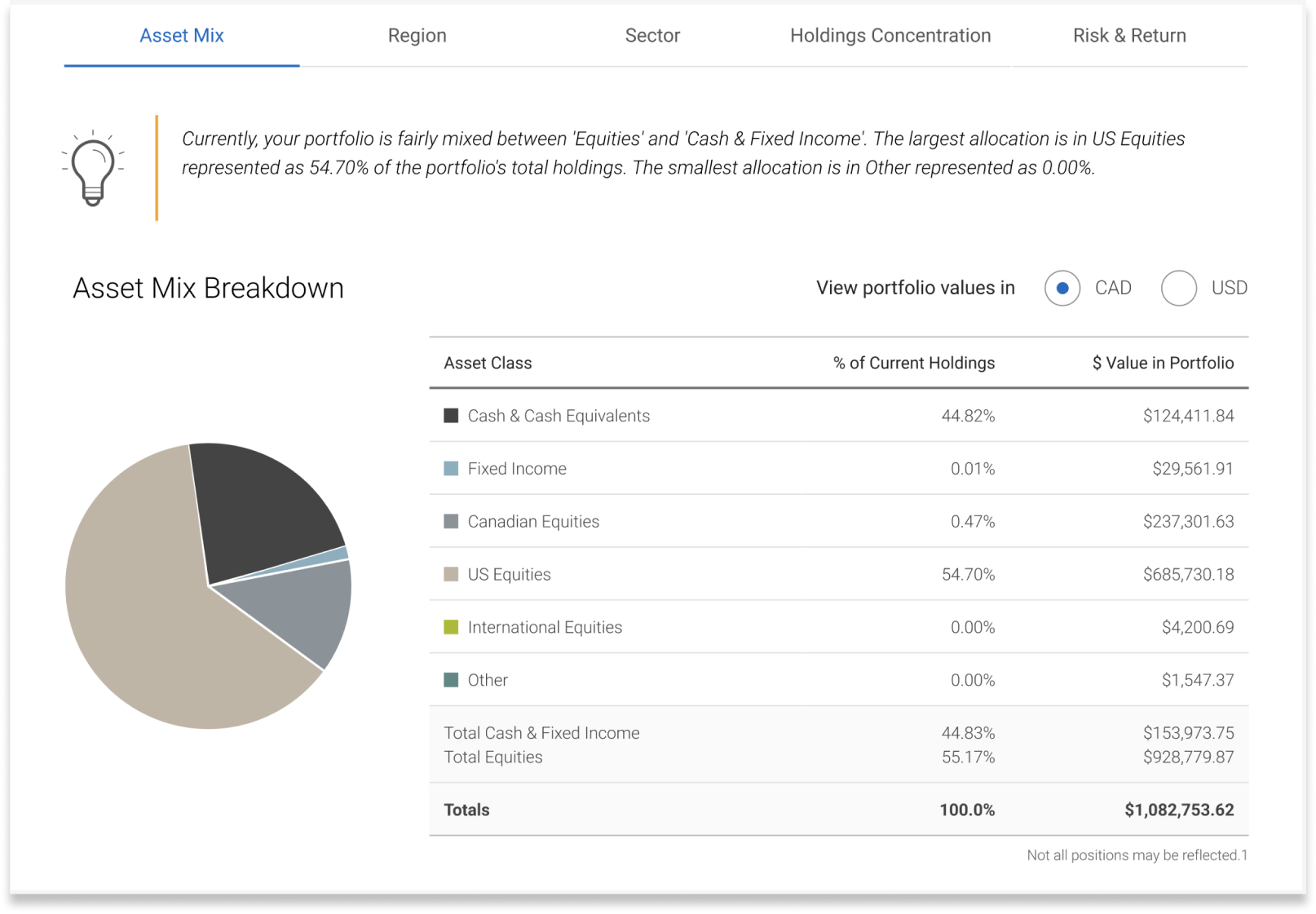

View Your Investment Mix and Monitor Risk with the Portfolio Analyzer

Easily view the mix of investments in your portfolio to check the diversification of your holdings. Also see where your portfolio lands on the risk/return scale and how it fits with your investor profile.

Keep Your Goals on Track with the Account Performance Tool

Easily measure and compare your investment portfolio’s rate of return against various benchmarks to make sure your investment strategy is in line with your long-term objectives.

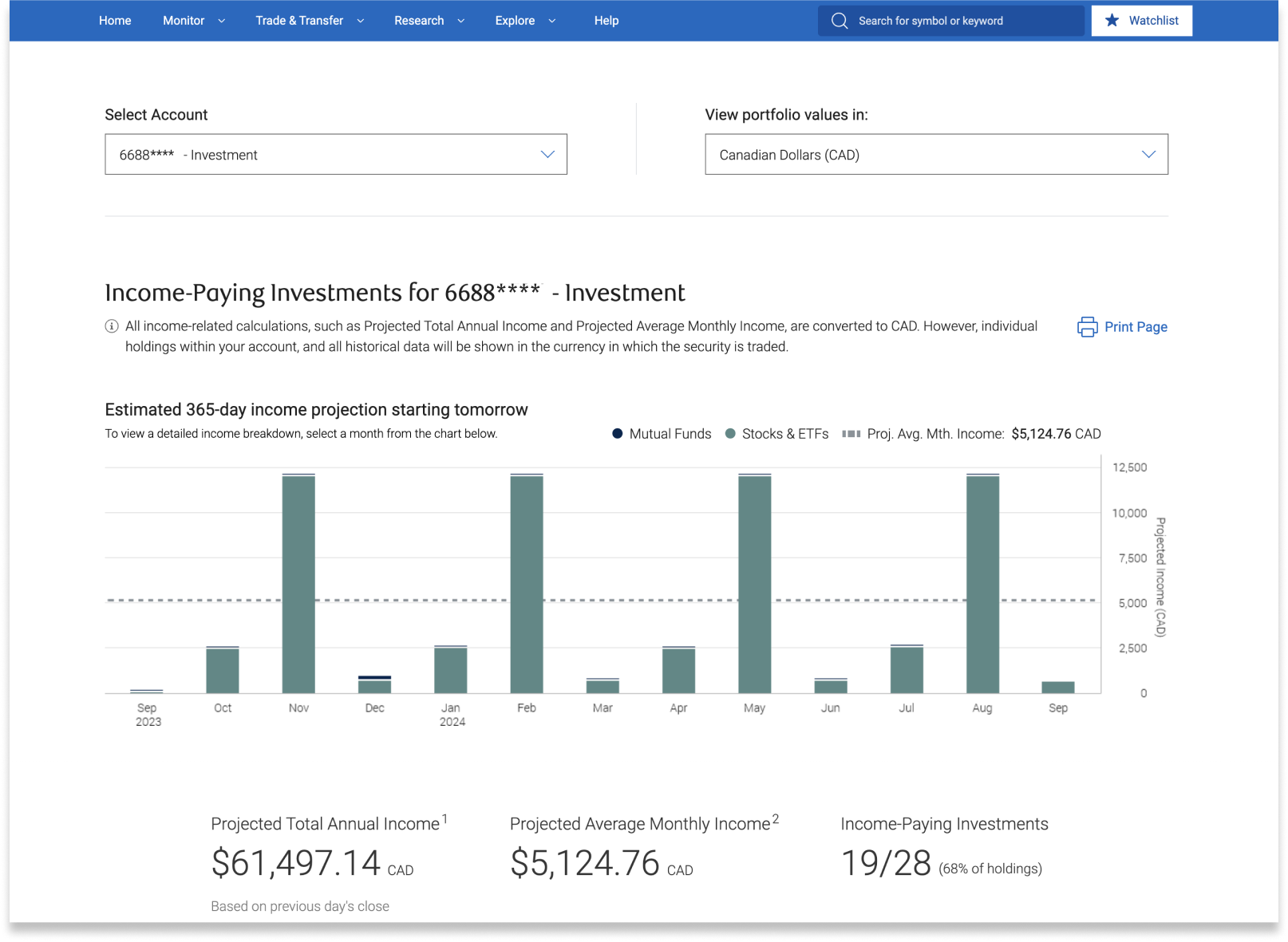

Estimate the Income You Could Get from Your Investments

Get a detailed projection of your future dividend and distribution income based on the historical data and forward estimates of your holdings using the Income Projection tool.

Keep an Eye on Investments You Hold with Watchlists

Set up watchlists to track the trading activity of your stocks, ETFs, options and other investments and access them anytime from the RBC Mobile app, Online Investing platform and Trading Dashboard.

Set Alerts for Stocks and Other Investments You Hold

Get updates for your stocks, ETFs and mutual funds on your mobile, desktop or tablet. For example, set an alert to know about price changes for a particular stock.

| Feature | Online Investing Platform | RBC MobileCompare Table Legal Disclaimer footnote 1 app | Trading Dashboard |

|---|---|---|---|

| North American Stocks and Options Trading | |||

| View and Monitor Your Accounts and Investments | |||

| Real-Time QuotesCompare Table Legal Disclaimer footnote 2 | |||

| Level 2 QuotesCompare Table Legal Disclaimer footnote 3 for Stocks and ETFs | |||

| News and Headlines | |||

| Watchlists | |||

| Fixed-Income Investments Search | |||

| North American Stocks and Options Trading | |||

| Real-Time QuotesCompare Table Legal Disclaimer footnote 2 | |||

| Real-Time StreamingCompare Table Legal Disclaimer footnote 4 Quotes for Stocks and ETFs | |||

| Level 2 QuotesCompare Table Legal Disclaimer footnote 3 for Stocks and ETFs | |||

| Trading with Avion Points | |||

| Pre-Market and After-Hours Trading | |||

| Dividend Reinvestment Plan (DRIP)Compare Table Legal Disclaimer footnote 5,Compare Table Legal Disclaimer footnote 6 Setup | |||

| Pre-Authorized Contribution (PAC) Plan Setup | |||

| Treasury Bill Rollover Setup | |||

| View and Monitor Your Accounts and Investments | |||

| Portfolio Analyzer, Account Performance and Income Projection Tools | |||

| Recent Events Driving Your HoldingsCompare Table Legal Disclaimer footnote 7 | |||

| Watchlists | |||

| Watchlists | |||

| Fixed-Income Investments Search | |||

| Custom and Pre-Defined Screeners/Filtered Lists for Stocks, Mutual Funds and ETFs | |||

| MorningstarCompare Table Legal Disclaimer footnote ‡ Research (Pick Lists, Editorials, Ratings and Research) | |||

| Sectors and Industries Analysis | |||

| Research by RBC Capital Markets, RBC Economics and More | |||

| News and Headlines | |||

| Consensus Upgrades and Downgrades by LSEGCompare Table Legal Disclaimer footnote ‡ | |||

| Street Consensus by Thomson Reuters | |||

| Alerts (Stock and Market) | |||

| Calendar (Earnings and Events) | |||

| FactSet Fundamentals, Estimates and Reference Data | |||

| Technical Analysis and Advanced Charting | |||

| Technical Analysis and Events from Trading CentralCompare Table Legal Disclaimer footnote ‡ | |||

| New Issues/IPOs Search | |||

| Educational Videos and Demos | |||

| Inspired Investor Trade | |||

| Practice Accounts | |||

|

|

|

|---|

. You may only use your Avion points through RBC DI to: (1) pay for Canadian or U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or (2) transfer points for cash contributions in CAD to your eligible RBC Direct Investing accounts. It is your responsibility to make sure you have sufficient contribution room within your registered plan when redeeming points for cash contributions in CAD to your registered accounts and/or when you use your Avion points to pay for Canadian or U.S. equity trade commissions on a registered account. The Canada Revenue Agency may apply tax penalties for over-contributions. RBC Direct Investing is not responsible for any such penalties.

. You may only use your Avion points through RBC DI to: (1) pay for Canadian or U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or (2) transfer points for cash contributions in CAD to your eligible RBC Direct Investing accounts. It is your responsibility to make sure you have sufficient contribution room within your registered plan when redeeming points for cash contributions in CAD to your registered accounts and/or when you use your Avion points to pay for Canadian or U.S. equity trade commissions on a registered account. The Canada Revenue Agency may apply tax penalties for over-contributions. RBC Direct Investing is not responsible for any such penalties.Choose the Platform that Gives You More.

Get the tools and research you need to empower and inform your investing decisions.

Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTools and Research FAQs

RBC Direct Investing clients can find investing articles and educational resources within the Online Investing platform under the Explore menu > Inspired Investor. Market commentary is available under the Research menu.

If you are not yet a client, you can also explore our digital magazine, Inspired Investor.

There are many ways to gain exposure to global or emerging markets through exchanged-traded funds (ETFs), mutual funds and American depository receipt (ADR) stocks.

To find ETFs or mutual funds on the Online Investing platform, log in to your account and select “ETF Screener” or “Mutual Fund Screener” under the Research menu > Screeners. You can choose from pre-defined screeners or click Create My Own to customize your screener to search for funds with exposure to global and emerging markets.

To search for ADR stocks on the Online Investing platform, log in to your account and select “Stocks & ETFs” or “Get a Quote” under the Trade and Transfer menu > Place an Order.

To learn more, log in to the Online Investing platform and explore the articles under the Investing Academy menu.

Both types of quotes provide real-time data but streaming quotes update automatically so you don't have to refresh or toggle between screens.

| Real-Time QuotesLegal Disclaimer footnote 7 | Real-Time Streaming Quotes |

|---|---|

| These give you pricing that's accurate at the moment you look up the quote. | These stream, so you don't have to refresh your screen to get automatic price updates. |

Real-time quotes are available for Practice Accounts as long as you also have at least one RBC Direct Investing account (which gives you access to real-time streaming and Level 2Legal Disclaimer footnote 10 quotes).

No, Level 2 quotes are not available for options and OTC securities.

If you're an Active TraderLegal Disclaimer footnote 9 who has signed exchange agreements, you will have access to Level 2 quotes for stocks and ETFs that trade on the Canadian Securities Exchange and Nasdaq—on the Trading Dashboard, Online Investing platform and the RBC MobileLegal Disclaimer footnote 3 app.

Placing a pre-market or after-hours trade online is no different than entering an order during regular hours. While there's no additional cost to you to trade outside of regular market hours, our standard pricingLegal Disclaimer footnote 8 applies. Any orders not fulfilled by the end of the pre-market or after-hours session will expire.

Pre-market quote data is added to the previous day's close quotes from 4:00 to 9:30 am.

Pre-market trading is only available for U.S. markets. You can make pre-market trades Monday to Friday at the following times:

- NYSE from 8:00 to 9:25 am ET

- NASDAQ from 8:00 to 9:25 am ET

Post-market quotes include intraday closing data, as well as data from 4:01 to 8:00 p.m. Between 8:00 p.m. and 4 a.m. the next trading day, you will see after-hours quotes.

You'll be able to make after-hours trades from Monday to Friday at the following times:

- Canada (TSX + TSX Venture) from 4:15 to 5:00 pm ET

- U.S. (Nasdaq + NYSE) from 4:01 to 5:00 pm ET

Yes, you can call 1-800-769-2560 to place trades over the phone for a minimum commission of $43 per trade. If you choose to trade online, you'll pay just $9.95 commission per trade.Legal Disclaimer footnote 8

POWERED BY