What is a TFSA?

TFSA stands for Tax-Free Savings Account. It’s a registered account that allows your investments—like stocks, ETFs, bonds, GICs, and more—to generally grow tax-free. Unlike an RRSP, contributions aren't tax-deductible, but, since you already paid tax on your contributions, withdrawals and investment gains are generally tax-free. Your TFSA contribution room has been accumulating since 2009 (or from the year you turned 18), even if you haven’t opened an account yet.

Benefits of a TFSA

Access your money at any time for any reason

Carry forward unused contribution room indefinitely

Contribute for as long as you want—no age limit

Numbers to Know

$0

Canadian taxes you’ll pay on TFSA earnings and qualifying withdrawalsLegal Disclaimer footnote 1

$7,000

2026 TFSA contribution limit

$109,000

Maximum lifetime contribution limitLegal Disclaimer footnote 2

A new, smart

way to invest.

Introducing GoSmart by RBC Direct Investing, designed for new investors and built to make investing easy.

Explore moreInvestments You Can Hold in Your TFSA

Enjoy total freedom to research and pick the investments that meet your needs.

Stocks

ETFs

Mutual Funds

GICs

Bonds

Options

Why Choose a Self-Directed TFSA at RBC Direct Investing?

Expand your investing knowledge with resources designed to help you take control:

- Find in-depth guides on the TFSA and other topics like stocks, options and more in the Investing Academy

- Learn the basics you need to build your strategy with the Investor’s Toolkit

- Watch educational videos and demos to see how to use our powerful trading platforms

Filter and choose investments using:

- Powerful screeners, market research and analysis, and more (Trading Tools and Investment Research)

- Economic insights on current events that could impact your investments

- Automatically reinvest dividendsLegal Disclaimer footnote 3 you earn from your equity investments

- Set up pre-authorized contributions to add money to your TFSA automatically and then invest it how you want

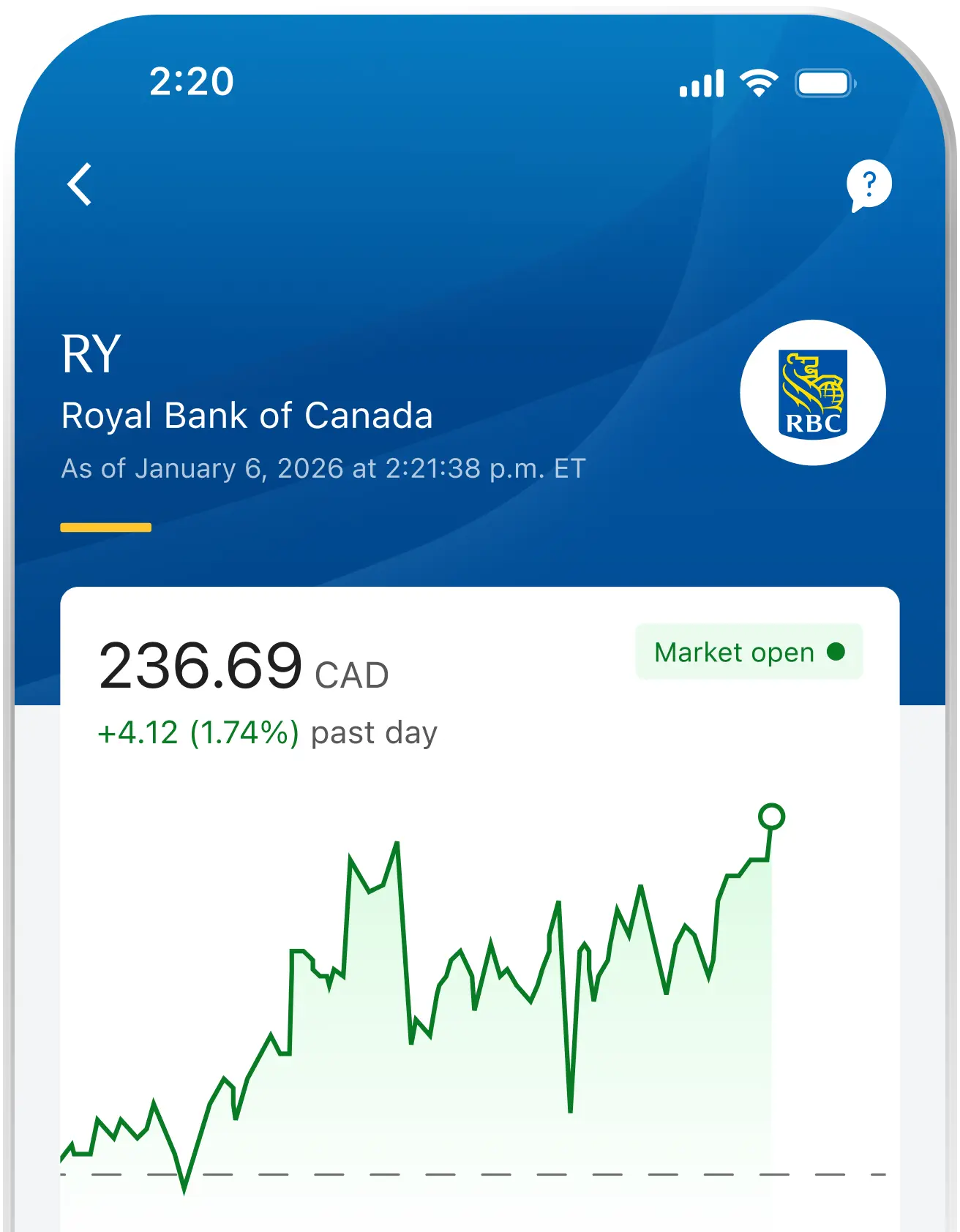

- Use the RBC MobileLegal Disclaimer footnote 4 app to act fast on opportunities

Receive guest access to our Online Investing platform with a risk-free Practice AccountLegal Disclaimer footnote 5. It’s a great way to practice buying and selling different investments before investing your own money. Free for RBC Online Banking and Direct Investing clients.

Note: Practice TFSAs are not available. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online.

Enjoy benefits like real-time streaming quotesLegal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:

- Pay just $9.95 commission per online trade with no minimum balance or activity.Legal Disclaimer footnote 7

- Use your Avion points for trade commissions or turn them into cash contributions.

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage.Legal Disclaimer footnote 8 (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.Legal Disclaimer footnote 9)