No account maintenance fees

Open as many accounts as you want and pay no account maintenance fees, no matter your balance or account type.

View PricingOver 50 commission-free ETFsLegal Disclaimer footnote 1 — including crypto, gold & silver ETFs

Focus on growth, with exposure to Bitcoin, Ethereum, gold & silver invest for income and more.

Explore ETFsEstablished Investors

Commission Free Mutual FundsLegal Disclaimer footnote 2

Choose from actively and passively managed mutual funds across investment strategies.

Explore Mutual FundsAccounts and investments that work for you.

Build the future you want. From a first home, to education and retirement, invest towards your goals with accounts and investments that meet your needs.

IDEAL FOR NEW INVESTORS

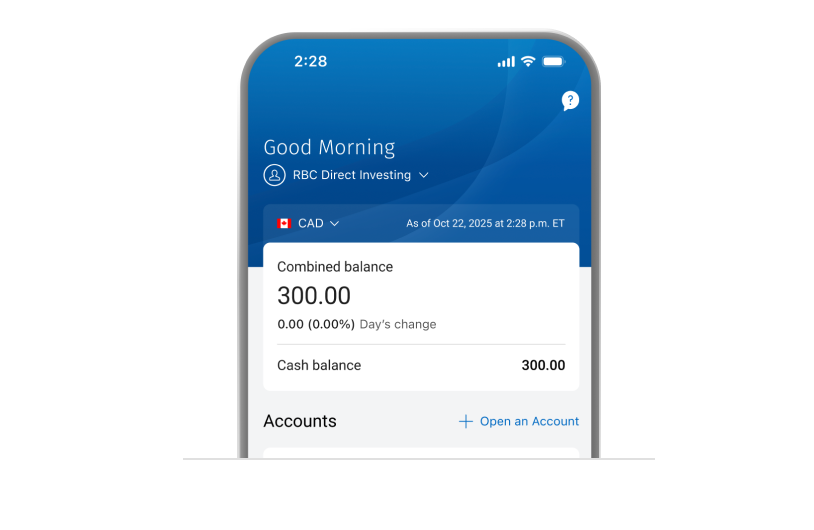

Commission-free investing in a streamlined, mobile-first environment

$0

/ trade

50 commission free trades per year on stocks and ETFs

Unlimited commission-free trades on select ETFs (opens new window)

Investments

Platforms

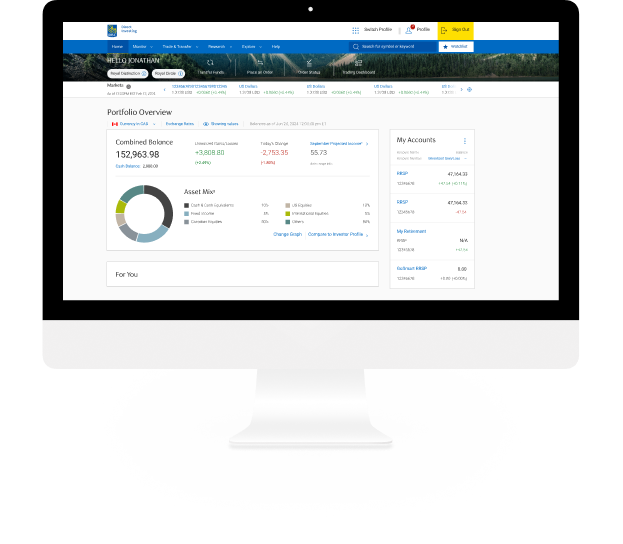

IDEAL FOR Established Investors

Full-Suite RBC Direct Investing

Full suite investing with more accounts, research and flexibility.

$9.95

/ trade

$6.95

/ trade

for 150+ trades per quarter

Unlimited commission-free trades on select ETFs (opens new window) and all mutual funds (opens new window)

Accounts

Investments

Trade your way

You’re always just a tap or click away from confidently managing your investments.

The RBC Mobile app lets you track investments and trade from anywhere. Move money and manage watchlists wherever you are.

Our online trading platform features real-time streaming quotes and event-driven insights to help drive your investment decisions.

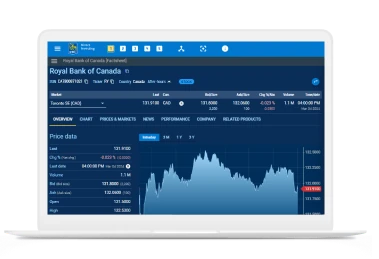

The Trading Dashboard can be fully customized with detailed metrics and advanced charting tools to match your investing style and needs.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage. (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.)

Self-Directed Investing and Trading FAQs

A GoSmart account is designed for beginning investors who are comfortable making their own investment decisions using the RBC Mobile App. Our aim is to simplify the process of ‘how to invest’ and provide commission-free trading in registered accounts.

It's easy. Visit Open an Account to get started. In many cases, your application will be approved in as little as 24 hours.

If you don't have an account with us yet, the easiest way to transfer an account from another institution is when you open your account online. If you're an existing client, you can use our secure online transfer form to transfer your account from another institution. You can also download the form and visit us in person, or call us at 1-800-769-2560.

For details, see Transfer from Another Brokerage (opens new window) or visit an Investor Centre (opens new window).

- Commission-free trading: Save the commission on all mutual fundsLegal Disclaimer footnote 2 and a selection of over 50 exchange-traded funds (ETFs)Legal Disclaimer footnote 1.

- Pay $0 maintenance fees: Some brokerages charge an account maintenance fee unless you meet certain conditions. At RBC Direct Investing, there’s no maintenance fee, no matter how much you invest—or the type of account you hold.

- Use your Avion Points to pay trade commissions: If you’re an Avion Rewards member and you have an eligible RBC Direct Investing account, you can use your Avion points to pay for online and mobile trade commissions—or to make cash contributions to your account.Legal Disclaimer footnote 3

- Transfer fees: Transferring from another brokerage? Move $15,000 or more and we'll reimburse you up to $200 for fees they charge.Legal Disclaimer footnote 4 ($500 in fees reimbursed for Royal Circle and Royal Distinction members.Legal Disclaimer footnote 5 )

See the Commissions and Fees Schedule.

GoSmart is currently just for RBC clients using the RBC Mobile app. Not a client of RBC yet? Explore more RBC Accounts (opens in a new window).

You do not need to be an RBC client to open a full-suite Direct Investing account.

GoSmart is a streamlined investing platform that only offers registered accounts in Canadian currency. A full-suite RBC Direct Investing account offers a wider range of investment products, both registered and non-registered accounts, multiple currencies, expanded tools and research geared towards established investors. GoSmart Comparison (opens in a new window).

You can trade for $0. You get unlimited trades on more than 50 select ETFs, plus 50 commission-free trades per year on Canadian and U.S. stocks and ETFs. After that, you pay $9.95 per trade. The RBC Direct Investing Commission and Fees schedule applies to a GoSmart account. Please visit www.rbcdirectinvesting.com/pricing (opens in a new window) for more information.

You can open as many registered accounts (RRSP, TFSA, FHSA) as you want. You can trade (buy or sell) U.S. and Canadian stocks and ETFs in your GoSmart account – as long as they are qualified investments.

Choose from stocks, ETFs, GICs, bonds, mutual funds and more when you open a full-suite RBC Direct Investing account.

Note: At this time, certain GICs cannot be purchased, sold or transferred into your FHSA.

- Canadian dollar only. You can trade and hold U.S. listed equities and ETFs but you cannot hold U.S. dollars. If you place a trade for a U.S. denominated security the current foreign exchange conversion rate will be applied.legal disclaimer 6

-

These investment products and features are not available in a GoSmart account:

- Mutual Funds

- Fixed Income

- Foreign Securities (securities listed outside of Canada and the United States)

- Options

- Margin

Access to the above is available through a full-suite RBC Direct Investing account.

- No transfers-in-kind: you cannot transfer securities to this account; you can transfer cash and securities out.

No, GoSmart accounts are not eligible for the offer.

GoSmart is a service offered by RBC Direct Investing Inc. RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ®/™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2026.