What is a RRSP?

RRSP stands for Registered Retirement Savings Plan. It’s a tax-advantaged, registered plan that can help you save for retirement and enjoy tax benefits, now and potentially in the future. Your RRSP contributions can be used to reduce your income tax today and any growth and income on your investments in the plan (such as dividends and capital gains) is tax-deferred until you make a withdrawal.

To learn more, check out RRSPs Explained: A Primer for Investors.

Benefits of an RRSP

An RRSP is a registered plan that lets you save for retirement faster by deferring taxes on investment earnings such as and . When you retire, you may be in a lower tax bracket, so your withdrawals may be taxed at a lower rate.

Contributions reduce your annual income, lowering your tax bill now

Only pay taxes on investment income when you take money out

Catch up on previous years’ unused contribution room

Numbers to Know

$32,490

2025 RRSP deduction limit or 18% of your earned income the previous year, whichever is lower

$60,000

Maximum amount you could borrow from your RRSP to buy your first homeLegal Disclaimer footnote 1

71

The year you turn 71 is the last year you can contribute to your RRSP before you need to convert it to an income option, like a RRIF

A new, smart

way to invest.

Introducing GoSmart by RBC Direct Investing, designed for new investors and built to make investing easy.

Hold a Range of Investments in Several Types of RRSPs

Open an ; and enjoy total freedom to research and pick investments that meet your needs.

Stocks

ETFs

Mutual Funds

GICs

Bonds

Options

Why Choose a Self-Directed RRSP at RBC Direct Investing?

Expand your investing knowledge with resources designed to help you take control:

- Find in-depth guides on the RRSP and other topics like stocks, options and more in the Investing Academy

- Learn the basics you need to build your strategy with the Investor’s Toolkit

- Watch educational videos and demos to see how to use our powerful trading platforms

Filter and choose investments using:

- Powerful screeners, market research and analysis, and more (Trading Tools and Investment Research)

- Economic insights on current events that could impact your investments

- Automatically reinvest dividendsLegal Disclaimer footnote 2 you earn from your equity investments

- Set up pre-authorized contributions to add money to your RRSP automatically and then invest it how you want

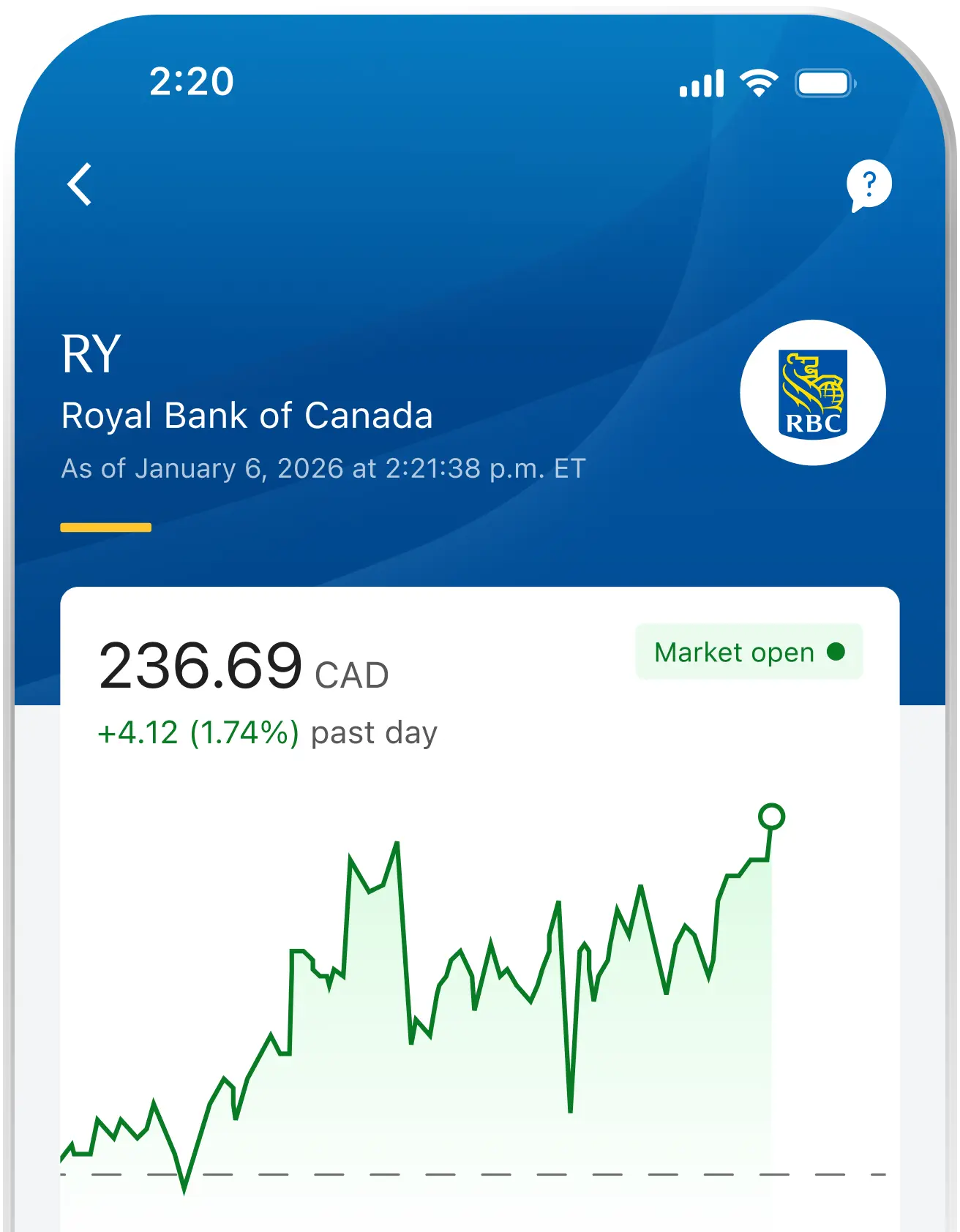

- Use the RBC MobileLegal Disclaimer footnote 3 app to act fast on opportunities

Receive guest access to our Online Investing platform with a risk-free Practice Account. It’s a great way to practice buying and selling different investments before investing your own money. Free for RBC Online Banking and RBC Direct Investing clients.

Enjoy benefits like real-time streaming quotesLegal Disclaimer footnote 4 and pre-market and after-hours trading at no additional cost:

- Pay just $9.95 commission per online trade with no minimum balance or activityLegal Disclaimer footnote 5

- Use your Avion points for trade commissions or turn them into cash contributions

Build Your Knowledge with Inspired Investor Trade

Check out Inspired Investor Trade and visit the Investing Academy to learn more about trading and investing in stocks, options, ETFs and more.

Open an account in minutes

You're Protected. Get 100% reimbursement for any unauthorized transactions conducted through the Online Investing platform or the RBC Mobile app.

See the GuaranteeTransfer $15,000 or more and we'll cover up to $200 in fees charged by your other brokerage.legal disclaimer 7 (Up to $500 in fees reimbursed for Royal Circle and Royal Distinction members.legal disclaimer 8)

RRSP FAQs

A Registered Retirement Savings Plan (RRSP) is a tax-advantaged registered plan that can help you save for retirement and enjoy tax benefits, now and potentially in the future. RRSP contributions can be used to reduce your income tax in the current year, and any growth and income on your investments in the plan (such as and ) is tax-deferred until withdrawn. The features, benefits and rules for RRSPs are determined by the Government of Canada.

To learn more, check out RRSPs Explained: A Primer for Investors.

A spousal RRSP is a retirement savings plan that allows one spouse or common-law partner to own the account and the other to contribute to the account. A spousal RRSP allows couples to even out retirement income to minimize income tax.

There are contribution limits on RRSPs. To find out the exact amount you can contribute for the current year, check your most recent Notice of Assessment from the Canada Revenue Agency (CRA).

As a guideline, your allowable RRSP contribution for the current year is the lower of:

- 18% of your earned income from the previous year

- The maximum annual contribution limit for the current tax year, minus your pension adjustment from company-sponsored pension plan contributions. Your unused contribution from previous years can also be carried forward.

A beneficiary named on your RRSP does not have to wait until after your bills are paid or assets distributed to receive the moneyLegal Disclaimer footnote 6. What’s more, naming your spouse/common-law partner or a dependent child as a beneficiary will allow your executor some flexibility in determining who pays the tax bill on your death—your estate, your beneficiary or a combination of both (for income-splitting purposes). Speak to your tax advisor and a lawyer familiar with estate planning laws in your province for more information.

If you are a Quebec resident, you cannot name a beneficiary directly on any registered account but you can set this up in your will.

You can hold stocks, exchange-traded funds (ETFs), options, mutual funds, bonds, GICs and more in your RRSP, as long as they are qualified investments.

Find out more about the investments you can hold in your RRSP in the Investing Academy.

Yes—you can use it to buy a home with the Home Buyers’ Plan or go back to school through the Lifelong Learning Plan. These let you borrow from your RRSP and pay it back over time without any penalty.

. You may only use your Avion points through RBC DI to: (1) pay for Canadian or U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or (2) transfer points for cash contributions in CAD to your eligible RBC Direct Investing accounts. It is your responsibility to make sure you have sufficient contribution room within your registered plan when redeeming points for cash contributions in CAD to your registered accounts and/or when you use your Avion points to pay for Canadian or U.S. equity trade commissions on a registered account. The Canada Revenue Agency may apply tax penalties for over-contributions. RBC Direct Investing is not responsible for any such penalties.

. You may only use your Avion points through RBC DI to: (1) pay for Canadian or U.S. equity trade commissions on your eligible RBC Direct Investing accounts; or (2) transfer points for cash contributions in CAD to your eligible RBC Direct Investing accounts. It is your responsibility to make sure you have sufficient contribution room within your registered plan when redeeming points for cash contributions in CAD to your registered accounts and/or when you use your Avion points to pay for Canadian or U.S. equity trade commissions on a registered account. The Canada Revenue Agency may apply tax penalties for over-contributions. RBC Direct Investing is not responsible for any such penalties.