Free Real-Time StreamingLegal Disclaimer 1 Quotes to Help You Invest in the Moment

Get free real-time streaming quotes for stocks and ETFs. Plus, get an extra line of sight with Level 2Legal Disclaimer 2 quotes—so you never miss an opportunity.

Stay in Touch With the Markets

Keep track of your securities with the convenience of watchlists, stay on top of market commentary and get alerts delivered to your inbox.

Three Powerful Trading Platforms - Choose What Suits Your Needs

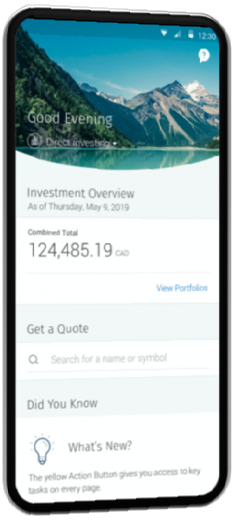

Use comprehensive tools and market research on our secure online investing site; drill down on quotes and take action in real-time through the trading dashboard; monitor your investments and make trades on the go using the RBC MobileLegal Disclaimer 3 app.

As an added benefit, RBC Royal Bank clients enjoy the convenience of a single sign-on, consolidated view and real-time transfers between your RBC Online Banking accounts and RBC Direct Investing accounts.

We offer a variety of account types and investment choices to help you create a portfolio that's right for you, including:

Be ready to make your next move by keeping up with the latest information. From screeners and analysis to help you narrow the search for investment opportunities to economic insights that help you understand the potential impact of current events, you'll find the details you need to keep up to date.

Experience what it's like to trade in the stock market without risking your own money. A Practice Accounts give you a real online trading experience, with access to many of the tools and features available in real accounts – right in our actual online investing site. You can do things like practice buying and selling different types of investments including stocks, ETFs and options, and track your holdings.

Our online magazine, Inspired Investor, brings you personal stories, timely information and expert insights to empower your investment decisions. It's also home to the Investing Academy, where you'll find a series of investing guides on topics like investing in stocks, options, naming beneficiaries and more. Visit rbc.com/inspiredinvestor to see what's new, and sign up for our newsletter.

The CommunityLegal Disclaimer 4 is a hub where anyone with an RBC Direct Investing account or Practice Account can join. Connect with other investors and see what they're holding, ask questions and share ideas in the forumsLegal Disclaimer 8 – all without revealing your identity or the value of your investments.

Complete your application online in just minutes.Legal Disclaimer 5

Pay just $9.95 commission per tradeLegal Disclaimer 6 with no minimum account balance or trading activity required.

Use your RBC Rewards for trade commissions or turn them into cash contributions

We'll cover up to $200 of your fees when you transfer $15,000 or more.Legal Disclaimer 7

It's easy. Visit our Open an Account page to get started. You'll be guided through the application process, which you can complete online for RRSP, RRIF, TFSA or Investment accounts or download an application form for RESP and non-personal accounts. You'll receive an email when your account is opened.

If you don't have an account with us yet, you can easily start the transfer process when you open your account online. If you're an existing client, use our secure online transfer form, to transfer your account from another institution. You can also download the form and visit us in person, or call us at 1–800–769–2560 with any questions.

For details, see Transfer from Another Brokerage or visit an Investor Centre.

Choose from Canadian and U.S. stocks; common and preferred shares; new issues; options; rights and warrants; equity, fixed income and money market mutual funds; exchange-traded funds (ETFs); and fixed-income investments such as T-bills, bonds and GICs.

A typical stock quote provides a snapshot of a company's price, trading volume and other information that can help you understand its performance and make investment decisions, as of a specific moment in time during the trading day, or after market close.

All exchange-listed stock and ETF quotes on our secure online investing site and the RBC Mobile app are available in real-timeLegal Disclaimer 9 without the typical 20-minute delay. Get free level 2 quotes for Canadian exchange-listed stocks and ETFs (TSX, TSX/V), and visit the trading dashboard for real-time streaming quotes – without hitting refresh.

It's easy to place an order – whether you're using the secure online investing site or the RBC Mobile app. Choose from different order types, like market orders, stop-limit orders and limit orders.

Watch: How to buy and sell a stock

Try our clickthrough demo to see how you can place a trade using our desktop site or the RBC Mobile app.

Stocks offer a variety of benefits for those who are comfortable with price fluctuations, like:

Exchange-traded funds (ETFs) offer a number of benefits, for those who are comfortable with price fluctuations, including:

If you're thinking about investing in mutual funds, here are a few advantages to consider:

Fixed-income investments can be useful in your portfolio for a number of reasons:

At RBC Direct Investing, all clients enjoy a low commission of $9.95 flat per trade with no minimum account balance or trading activity required. This is in addition to the cost of the security or securities you're purchasing.

Commissions on stocks, ETFs and options:

No mutual fund commissions

There are no commissions charged to buy, sell or switch mutual funds using our online investing site or RBC Mobile app.

No maintenance fees

There is no maintenance fee for clients with combined assets of $15,000 or more across all of their RBC Direct Investing accounts. A fee of $25 per quarter applies to clients with combined assets of less than $15,000 in all of their RBC Direct Investing accounts.

Competitive interest rates on fixed-income and margin account loans

RBC Direct Investing offers access to one of Canada's largest online fixed income inventories. View a selection of our broad and diverse bond and GIC offerings, and find our rates on margin account loans.

For full details on all of our pricing, and ways to have the maintenance fee waived, please view our complete Commissions and Fees Schedule.

Enjoy no maintenance feeLegal Disclaimer 11 when you hold combined assets of $15,000 or more across your RBC Direct Investing accounts. And there are several other ways to lower your fees at RBC Direct Investing. For example, set up a Pre–Authorized Contribution PlanLegal Disclaimer 12 of at least $100 per month ($300 per quarter).

See our Pricing page for more ways to save on fees with us.

While many GICs cannot be sold prior to maturity, RBC Direct Investing offers cashable GICs that can be redeemed after 30 days.

The commission for GICs is included in the quoted price.Legal Disclaimer 13 For T-bills, Bonds, Debentures and Money Market Instruments, a commission of $25 - $250 per transaction is included in quoted price.

RBC Direct Investing clients can access real-time quotes7 on any of our three platforms – desktop, mobile app, and Trading Dashboard. Simply log-in to search for a quote or check your Watchlist!

Sign-in to Your Watchlist Here

Not yet a client? Check out our practice account

The Avion Rewards program is offered by Royal Bank of Canada and is subject to the Avion Rewards Terms & Conditions. You may only use your Avion points through RBC DI to: (1) pay for trade commissions on your eligible RBC Direct Investing accounts; or (2) transfer points for cash contributions to your eligible RBC Direct Investing accounts. It is your responsibility to make sure you have sufficient contribution room within your registered plan when redeeming points for cash contributions to your registered accounts and/or when you use your Avion points to pay for trade commissions on a registered account. The Canada Revenue Agency may apply tax penalties for over-contributions. RBC Direct Investing is not responsible for any such penalties.

There may be commissions, trailing commissions, investment fund management fees and expenses associated with investment fund and exchange-traded fund (ETF) investments. On or after June 1, 2022, any trailing commissions paid to RBC Direct Investing Inc. will be rebated to clients pursuant to applicable regulatory exemptions. Before investing, please review the applicable fees, expenses and charges relating to the fund as disclosed in the prospectus, fund facts or ETF facts. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.